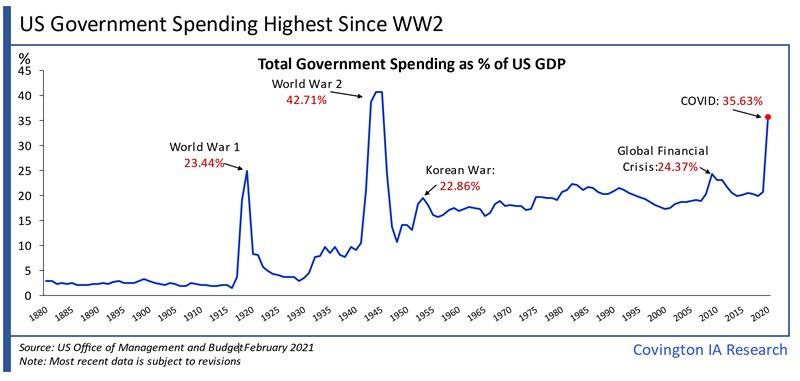

Inflation data continued to surprise to the upside with last week's CPI reading shocking markets and lead the Federal Reserve to announce another 75bps rate hike yesterday. The fed funds rate is now in the target range of 3% to 3.25%. In our opinion inflation has likely peaked but remains elevated enough that a quick dovish pivot by the central bank is not in the cards. You'll remember from our note last year (here) that when the Federal Reserve begins tightening policy and raising interest rates it is essentially the economic equivalent to a punch bowl being pulled away at a party. While we were not surprised that the Fed was tightening policy we have been surprised by the speed of policy change. For perspective, at the beginning of the year markets were pricing in a federal funds rate at sub 1%, now futures markets are pricing in a rate above 4% for 2023.

So now that we have embarked on a changing policy journey, where does it end?The truth is I don't think even Chairman Powell knows the answer as to what the terminal rate will be in a year. Like mentioned previously the market sort of does this for him by pricing in the terminal rate years ahead using futures contracts. Still, the procedure for central banks has always been more of a guess-and-check process where they begin raising rates until something in the market forces them to reverse course. On our chart today I plot some of these events and you can see they are wide ranging as far as which area of the market is most affected and ends up defining the tightening period. But one thing is common amongst them: most are pockets of excess where prices became irrational. Also notice how many of these are relatively illiquid or obscure with many taking place in emerging or debt markets...

..

..