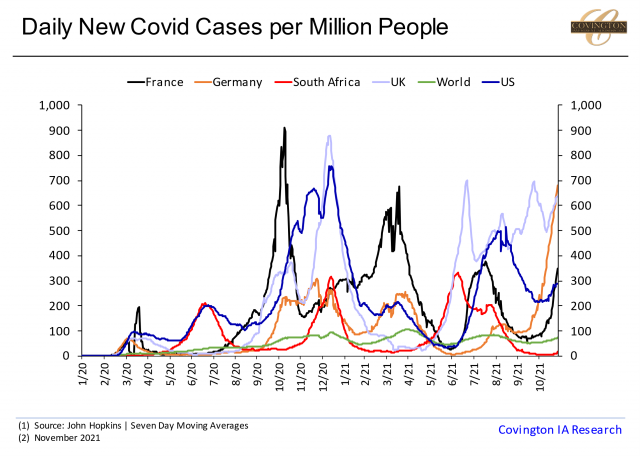

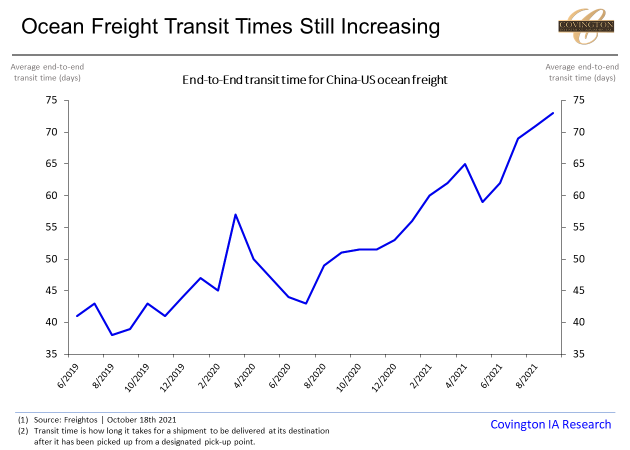

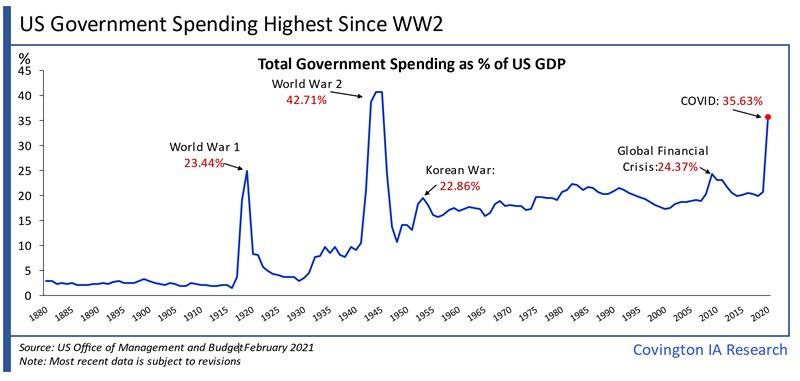

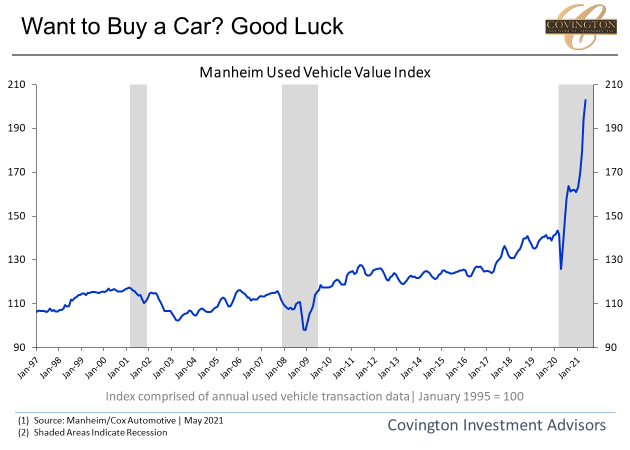

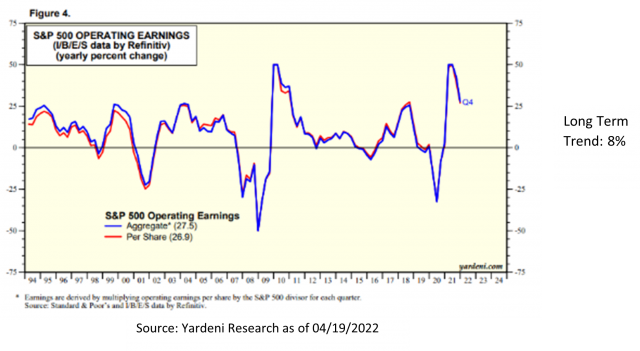

The economic momentum continued its recovery from the pandemic induced lockdowns in the 1st quarter 2021 with real GDP expanding at an annual rate of 6.4% in the first quarter of 2021. Massive spending measures by the government, unprecedented Fed policy measures, overall strong employment recovery and greater vaccination rates drove strong economic activity, delivering strong S&P 500 operating earnings largely above expectations up 34.1% year over year trending at $187.43 from $139.00 at year end. Inflation reached 2.6% in the first quarter due to reopening demand along with material and product shortages. Consumer spending expanded 10.7% at an annual rate in the first quarter supported by strong household income as federal stimulus checks continue.

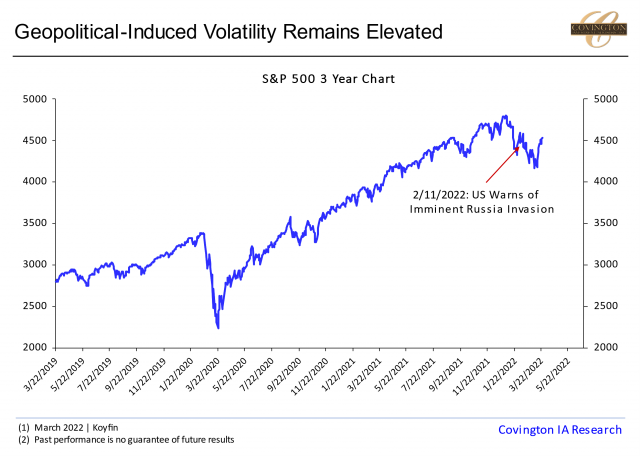

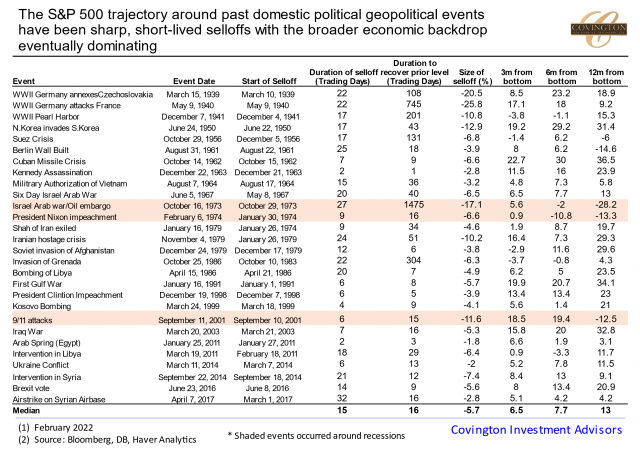

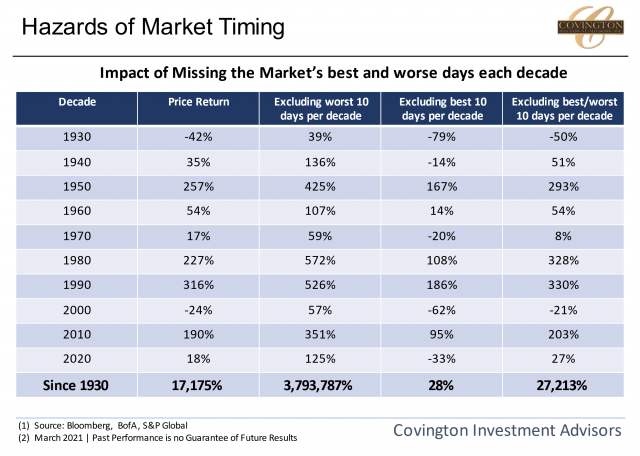

The rotation into cyclical – value stocks which started last September continued in the first quarter which helped thrust the S&P 500 to new highs despite consolidation in the mega caps. Equity markets are priced to perfection, however, on the assumption rates will remain low for a long time. I think you could see a serious correction in asset prices if the Fed must tighten monetary policy to combat inflation. The Fed has warned asset valuations are high and vulnerable noting the economy is a long way from their goals. While high priced stocks could eventually earn the profit necessary to justify today’s valuations under a completely opened economy, what happens when the fiscal stimulus is turned off? And how will the markets react to the beginning of the Fed tapering? Additionally, while the virus remains the greatest threat to the economy, what Black Swan events are unforeseen due to the excessive liquidity in the economic system and how will current inflation pressures play out in the economy?

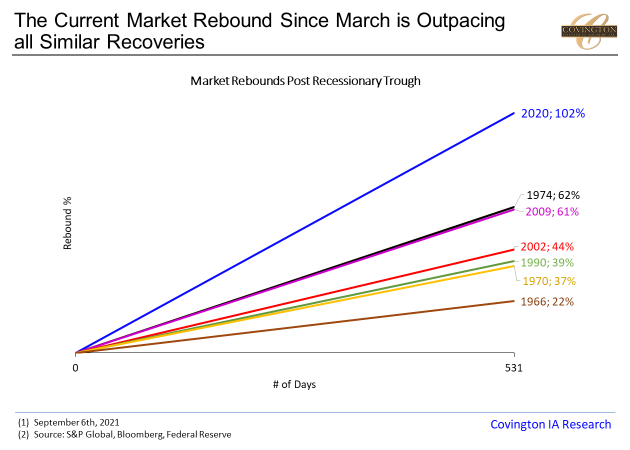

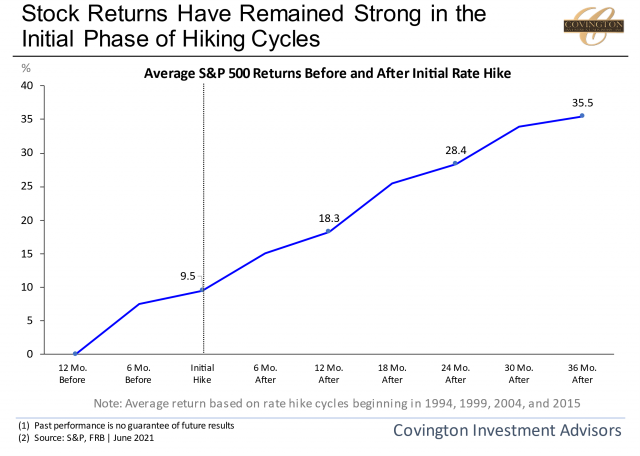

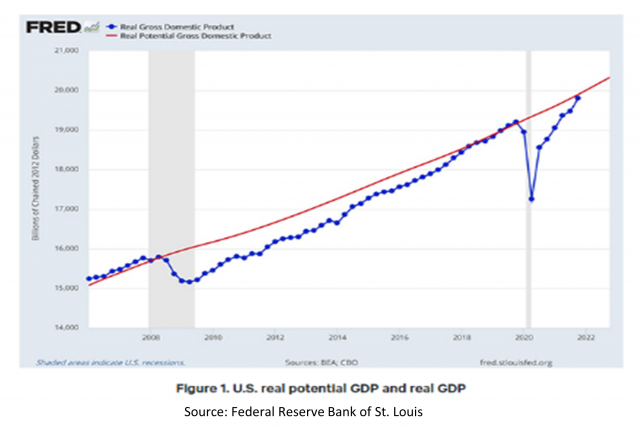

The pandemic lockdown induced recession appears to have ended May 2020 looking at the Leading Economic Index and the ISM Purchasing Managers Indexes. Now we are at the beginning stages of a new cyclical bull market exhibited by an acceleration after the economy troughs. In this phase of the business cycle, the Fed keeps rates low while credit conditions trough allowing stocks to advance sharply until interest rates rise. U.S. stock sectors that perform well in the early cycle are typically materials, financials, industrials, information technology and consumer discretionary stocks.While economic growth looks good short term and earnings have rebounded strongly recently what happens when growth moderates after a fully opened economy returns to trend line growth? Asset prices will have to correct under a reversion of the means representing historical multiples...

..

..