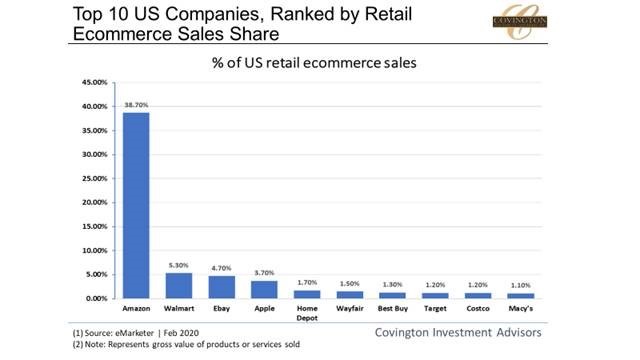

When a pivotal economic event takes place like we are experiencing with the coronavirus pandemic there are certain trends that begin to either arise or quickly accelerate. We think the latter is currently happening with Ecommerce. It is no secret that for many years online shopping has been taking market share from brick and mortar retail. But never before have we seen a scenario where many brick and mortar retails were forced to close shop and deemed “non-essential”, while the large online market places became the essential way for consumers to get the goods they needed. Some could argue that Amazon & Walmart, the two largest Ecommerce retailers, became a staple of national security for their distribution capabilities as citizens are quarantined in their homes.

Much of this gained business is due to many small retailers simply being forced to close for several months, but we think that Ecommerce retailers will keep a good portion of the gained customers even after government shutdowns are lifted. In late April during Microsoft’s Q3 earnings call, CEO Satya Nadella remarked that “We have seen two years’ worth of digital transformation in two months” as Microsoft provides part of the digital infrastructure that Ecommerce retailers use. The graphics below show the dramatic penetration that online sales have reached along with the industry distribution due to this new world of the government forcing citizens to stay in their homes...

..

..

..

..

..

..

..

..