Covington Investment Advisors, Inc. Blog

The Charles Schwab Corporation and TD Ameritrade Holding Corporation announced yesterday that they have entered into a definitive agreement for Schwab to acquire TD Ameritrade in an all-stock transaction valued at approximately $26 billion. The combination brings together two leading firms with proud and similar histories of making investing more accessible to all. Please see below some important highlights of the press release. Click here to see the full press release.

This transaction creates strategic benefits for the combined organization and will further improve the investing and trading experience to both Schwab and TD Ameritrade clients. It allows Schwab to continue to add further scale on top of its organic growth, helping to drive sustainable, profitable growth and long-term value creation. Clients of both firms should benefit from the broader and deeper array of services. The resulting combined firm is expected to serve 24 million client accounts with more than $5 trillion in client assets. The acquisition will add to Schwab approximately $5 billion more in annual revenue with approximately $1.8 to $2 billion in expense synergies.

The parties expect the transaction to close in the second half of 2020 and will begin the integration process immediately thereafter. The integration process is expected to take between 18-36 months, following the close of the transaction...

Recently Federal Reserve Chairman, Jerome Powell, said he sees the economy as being “in a good place”.

So, what’s good about the economy? The Bull Market Powers On!

- October Jobs report came in at 128,000 new jobs created vs 85,000 expected according to a Bloomberg survey.

- GDP rose 1.9% in the 3rd Quarter compared to 2% in the 2nd quarter, stronger than expected with economists forecasting 1.6%.

- Consumer sentiment has remained strong with the unemployment rate at a half a century low of 3.6% and wages now growing at a 3% inflation rate.

- Consumer spending while moderating to a 2.9% annual rate in the 3rd quarter off from a 4.6% rate in the 2nd quarter still compares favorably to last year’s 3rd quarter rate of 2.5%.

- The US housing sector has improved with lower interest rates and according to the US Census Bureau and US Department of Housing and Urban Development, residential home sales as of September 2019 are up 15.5% versus September 2018.

- Benign Inflation.

- The possibility for Tax Cut 2.0 that caters to the middle class.

- No signs currently for the Fed to raise rates.

So what’s bad about the economy?..

I am pleased to announce that Hannah Patton, Client Services Administrator at Covington Investment Advisors, was recently awarded the Certified Trust & Financial Advisor (CTFA) certification from the American Bankers Association (ABA).

The CTFA certification is awarded to individuals who demonstrate excellence in the field of wealth management and trust. To qualify for the CTFA certification, individuals must have certain levels of experience and education in the trust profession, pass an exam, and agree to abide by a code of ethics.

The CTFA exam covers many areas, including fiduciary and trust activities, financial planning, tax law and planning, investment management and ethics. In addition to the CTFA designation, Hannah has also received Certificate in Trusts for her completion of the ABA Trust Schools in the Foundational, Intermediate, and Advanced levels over the past three years. This expansion of Hannah’s knowledge base will be a great asset to Covington and our clients. ..

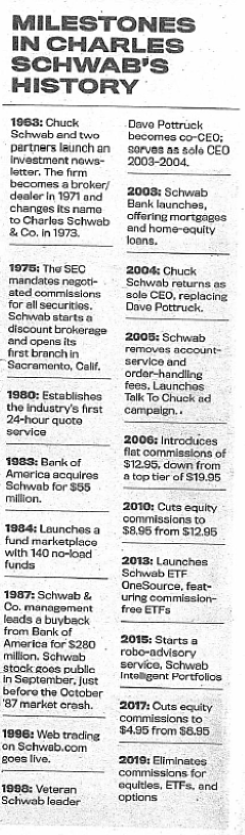

Who doesn’t love FREE? Let’s face it, we all love a good bargain or free item. “Discount Chuck” is looking out for individual investors again, slashing online equity and ETF trading commissions from $4.95 to ZERO, making it even more affordable to invest. Schwab will continue to charge a commission for trading of foreign stocks, fixed-income investments, transaction-fee mutual funds, options, and large block trades that require special handling.

Since 2006, Charles Schwab has been disrupting the brokerage industry by periodically reducing their trading commissions. Revenue will be derived from Schwab’s other business lines like its US Bank (Schwab Bank) and from net interest income. Charles Schwab continues to be a leading provider of financial services with more than $3.72 trillion in client assets as of August 31, 2019. Covington has utilized Charles Schwab as our Custodian of client assets since our inception. We continue to choose Schwab because they are economical and have best in class service, industry leading technology, broad range of investment solutions, and account security safeguards; all of which allow us to best serve the needs of our clients. See below the historical milestones of the Charles Schwab Corporation.

..

..

In the spirit of Cyber Security Awareness Month, I wanted to highlight two growing trends and share some tips to help you stay safe when using your cell phone and home phone. Beware of a new variation of phishing called SMiShing and the other tactics which spoof local phone numbers to entice you to answer the call.

SMiShing uses SMS (for “short message service”) to commit fraud by texting your phone. Text messages are very popular and usually opened and responded to immediately making it a successful practice used by fraudsters. SMiShing attempts are also popping up on messaging apps such as Facebook Messenger and WhatsApp. The text message may include a link to click on or a message urging you to respond quickly similar to the way phishing e-mails are handled. The fraudster’s goal is to steal your money by getting your personal information.

If you receive an unsolicited text, simply pause. Any reply – even to opt-out – to a text message makes your phone number legitimate for the fraudster and susceptible to more scamming attempts. If you receive a text from a “5000” number, it is most likely sent from an e-mail. It is recommended to block the sender of a text message by forwarding the text to “7726” which spells “SPAM.” This number works for most major carriers. Your phone may also allow you to block numbers from the “settings” application. Or, simply delete the text...

Last year, the Securities and Exchange Commission (“SEC”) identified a trend in their examinations that investment advisory firms were not adequately disclosing that a conflict of interest existed. In general, the investment advisors may have had compensation related incentives to place clients in the higher-cost mutual fund share classes when lower-cost share classes of the same fund were available. Investment advisors have a fiduciary duty to place your interests ahead of theirs and disclose conflicts of interest. In an effort to correct the situation, the SEC launched the “Mutual Fund Share Class Initiative” which allowed investment advisory firms to voluntarily report a violation of the Investment Advisors Act of 1940 resulting in 79 firms returning $125 million to harmed investors.

The SEC is dedicated to protecting main street investors, but investors must also take steps to protect themselves. I think it’s safe to assume that we are very resourceful when researching medical conditions or making a purchase by consulting with family, friends, and the internet. We would encourage you to check the background of your investment advisor, registered representative, or insurance broker with as much scrutiny. Professionals providing financial products or services should be registered. One way you can review the professional’s background is the investment advisor repository database website at www.iard.com or FINRA broker check at www.brokercheck.finra.org. For insurance brokers, you can check their license with the state insurance commission. A complete listing of each state insurance commission is available at www.naic.org. The professional you are working with may be registered with one or more of the examples listed. We would also encourage you to read the investment professional’s disclosure documents, such as Form ADV or the terms and conditions of the contract, before signing a contract in order to make an informed decision.

Additionally, you may wish to obtain a second opinion from another professional. It’s your retirement, college savings, wedding fund, or rainy-day fund that could be jeopardized unnecessarily. Be sure to ask questions about fees involved with the investment or any compensation the individual may receive from your investment. If you are considering a rollover from an employer sponsored retirement plan, we would recommend asking about the pros and cons of keeping it at your previous employer versus rolling it over into an IRA...

The Dow posted its largest decline of 2019 Wednesday as the bond market signaled a warning of a potential pending recession. With weak economic data coming out of China and Germany, the second and fourth largest economies, respectively, there are worries that we are in the midst of a broad global economic slowdown. As stated in the Wall Street Journal, the good news is that unlike the 1990’s with the Tech boom or the mid 2000’s with a housing boom, the US is not confronted with severe excesses to unwind. As such, any downturn might be mild.

When market volatility picks up, it is reasonable for investors to get antsy about their investments and lose confidence in the market. We believe volatility provides a perfect opportunity to calibrate our investment philosophy and not get sucked into media headlines or brash reactions. Although we identify where we are in economic and market cycles and position portfolios to benefit from these cycles, we do not try to time the market. We are long term investors, not traders. By identifying that we are in the beginning stages of a downward cycle, we are able to make changes in a portfolio to be more defensive and try to safeguard our investments. For example, recently we have taken several steps to shield the portfolios from risks that we currently identify by selling positions, raising cash, and taking a more cautious approach to investing new monies.

Our investment process comes from more of a bottom up approach. Meaning we try to analyze specific companies who can perform well in all market cycles. Instead of trying to predict what will happen in the next week, quarter, or year and basing our investment choices off of a prediction, we try to invest in good companies. When we pick companies, we strive to choose companies that we think of as “recession resistant”. This does not necessarily mean that its stock price will not be negatively impacted during a market sell-off. Our definition of recession resistant means that the companies’ long-term value will not be materially affected and the business will not be forced to change its financial situation or market position during a downturn in the cycle. Quite the contrary, we believe that many of our companies’ competitive positions would become stronger through a recession and are in a position to take market share from competitors...

It’s official, Nick is out of the living room! Construction is over at Covington!

If you have visited our office in the past year you may have noticed a few out of the ordinary things; our Research Analyst, Nick Allen, working in the living room, loud noises, ladders, construction workers, etc. Well, this was all a part of our expansion, adding more office space upstairs to keep up with the growing needs of our company. I am happy to announce the addition at Covington has now been completed. I would like to take you on a virtual tour of our new office space, starting with the outside of the building.

New view from the front of the building..

Tariffs have been at the forefront of economic headlines over the past year. If the market headlines do not include “United States Threatens to Impose New Tariffs” then it most likely includes “Markets rise on the hope of a Trade Deal”. This has been the never ending cycle for the last year. On May 10th, 2019 the Trump Administration announced that a 25% tariff would be placed on an additional $250 Billion worth of Chinese goods being imported to the US. This tariff levying once again shocked markets and sent them trading lower the following week. Although we follow these developments daily it is important to understand the impact that this political risk has on your investments.

Measuring The Effects Of The Trade War

Trade tensions, specifically tariffs, affect the economy and market in a number of different ways. Certain aspects of a ‘Trade War’ are relatively easy to quantify but most are difficult to predict exactly what the long term affects will be. One of the dynamics of tariffs that is relatively easy to quantify is the effect they have on corporate profit margins. According to Empirical Research Partners, the tariffs administered in 2018 decreased S&P profit margins by 2%. This number can be increased now that the amount of goods being penalized has increased. Profit margins are one of the most important factors affecting stock prices so any negative affects to profit margins will translate over to stock prices. Tariffs also affect GDP. The graph below provided by TD Bank illustrates the incremental effects that increasing the amount of goods subject to tariffs has on GDP. Although Q1 2019 GDP of 3.2% was strong, part of this could be contributed to rising inventories. One reason companies may be increasing inventories is to brace for an increase in the cost of imported goods...

Covington Investment Advisors is continuing to expand in order to best serve the needs of our clients. Our office expansion efforts are underway and are nearing completion in the next few months. The expansion will provide us with more office space upstairs. You can see some pictures of the progress below. With our expanding space and client base, you may see some new faces at Covington soon. We would like to now introduce our newest hire, Nick Allen, an upcoming graduate of Indiana University of Pennsylvania. Nick will be joining us as a Research Analyst and has been interning at Covington since May.

..

There is a lot of noise in the markets in recent days. It is important to understand and stick to sound investment fundamentals under such circumstances. The market is currently adjusting to slowing earnings going into 2019, slowing global GDP growth, higher inflation and higher interest rates. You have probably heard me say: “What earnings do, the market does”. Moving from an earnings growth rate of 26.32% in 2018 to what is expected to be a 7% earnings growth rate in 2019 is a big change. We still have positive economic growth but we also have new policies that need to be absorbed into the economy. Additionally, all bull market cycles are killed by the Fed raising rates. The longest economic expansion in US history is coming to an end thanks to the Fed. When the Fed stops talking about raising rates the market will settle down.

Today’s activities in the market represent an adjustment period in the normal course of a business cycle. It is not the end of the world as the talking heads of the media will make it out to be but a process that is actually healthy for the markets to complete so we can move forward. This is the purpose of the rate cycle change; to transition the economy into a moderate pace of growth without too much inflation. In monitoring these matters we have taken steps to protect our client’s portfolios from this increase in market volatility as the economy transitions to a slower pace of growth.

..

Covington recently presented their observations on the market and economy at our annual shooting event held at Pike Run Country Club. Please find our presentation commentary below.

Economic Update

Looking at the business cycle framework, global expansion remains solid but many major economies have progressed toward more advanced stages of the business cycle where growth is moderating, credit tightens, and earnings start to come under pressure. Emerging markets face headwinds from China's industrial slowdown, looming trade uncertainties, and global monetary tightening. Europe has experienced the most significant slowdown among developed regions...

October is recognized as National Cyber Security Awareness Month, and I’m happy to promote some best practices to help you stay safe online. At Covington, we are vigilant in addressing cyber security risks at all times. It is an ongoing topic of concern for us, our clients, and our regulators. We hope you find this topic informative and helpful in protecting yourself online.

You’ve heard it before—regularly change your passwords. Who has time for that? Do you also use the same or similar password for multiple login accounts? To be honest, I’m guilty of some of this practice. Ultimately, I am not keeping my private data secure, and what’s worse is that I only use my one personal e-mail address for everything. Sound familiar to you?

Receiving sensitive information to your one e-mail address is all too common for many. I have my personal correspondence, vacation information (flights, hotels, car rentals), my financial statements, my house purchase, my health information, my tax filings, etc. going into my personal e-mail address. If someone were to gain access to my personal e-mail account, they would be able to know my life story, including where I like to shop, where I do business, and my personal finances. I don’t delete some of those important emails because they serve as my back-up. Come to think about it, when was the last time I changed my e-mail account password? Well, I did when they sent out a general e-mail stating that my account may have been hacked. Otherwise, never, because I can easily access my e-mail on my phone app with a push of a button without having to login. In order to change my password, I would need to go to the website and then have to remember my password to access my account. (Note to self: That is no excuse, Sarah!)..

The S&P 500 telecommunication sector is getting a new look. For years, the telecom sector has been one of the smallest sectors in the S&P and dominated by two names; Verizon and AT&T. This fall, the telecom sector will be replaced with a new sector labeled as the ‘Communication Services Sector’. As the name implies, the new sector will be more geared towards the way that media is now delivered to customers such as streaming and downloads. Morgan Stanley Capital International, typically abbreviated MSCI, summarized the new sector on their website:

“The last several years have seen an evolution in the way we communicate and access entertainment content and other information. This evolution is a result of integration between telecommunications, media, and internet companies. Companies have further moved in this direction by consolidating through mergers and acquisitions and many now offer bundled services such as cable, internet services, and telephone services. Some of these companies also create interactive entertainment content and aggregate information that is delivered through multiple platforms such as cable and internet, as well as accessed on cellular phones.”

The new sector will be comprised of names pulled from the Information Technology, Consumer Discretionary, and the old Telecom sector. In addition to AT&T and Verizon, the top 10 holdings in the new Communication Services Index will include three of the four FANG stocks – Facebook, Inc. (FB), Netflix, Inc. (NFLX) and Google parent Alphabet Inc. (GOOGL). The other notable holdings include Disney (DIS), Activision Blizzard (ATVI), Comcast (CMCSA), and Charter Communications (CHTR). "The index has 26 constituents with a total market cap of $2.35 trillion, average market cap of $92.5 billion and median market cap of $34.9 billion as of May 16, 2018," said S&P...

I am pleased to announce that we have hired Mr. Nick Allen to work as an intern this summer. He will be assigned a number of projects for the company including various analyses, research projects and technology studies.

Nick is a finance major at Indiana University of Pennsylvania (IUP) and is on track to graduate in December of this year. His courses of study include finance, investment, economics and management. Nick also serves as the Sector Leader of the Consumer Staples Section of the Student Managed Investment Portfolio organization at the college. This student organization is quite successful as it currently has $1.7 million in assets under management and has outperformed the S&P 500 over the last five quarters.

In addition to his financial studies and experiences, Nick has worked in the computer labs for the IUP Libraries. In this capacity he assists library employees and patrons with computer hardware and software issues and provided assistance through the IT Help Desk...

Fifteen years ago today Covington Investment Advisors was incorporated. The success we have had with and for our clients has allowed us to grow, hire more talent, continually enhance our technology, purchase our building, contribute to our communities’ societal needs, and expand our overall processes to customize your financial plans providing best in class investment management services and results.

I do not hesitate to say we have formulated the best in class advisory firm as we are not a broker-dealer, nor are we affiliated with one. As an independent advisor, we have an open architectural structure to find the best financial solutions for you. We cut out all the unnecessary middlemen and their fees and we refuse any form of commissions. We are an advisory fee-based only firm. We do not sell products; we provide customized financial plans structured and managed on a separate account basis driven to address your individual investment and family needs. As a federally registered investment advisor with the Securities Exchange Commission (SEC) we are a corporate fiduciary held to a higher standard of care. The growth of the firm speaks to our results over the past fifteen years. All one hundred six family relationships we now manage are the result of referrals based on our performance--referrals made because we took care of our clients one at a time carefully facilitating each individual financial, succession and generational estate plan while generating attractive investment results through various market environments.

So, thank you for your confidence in our services. Thank you for believing in our small private business model. Going forward please know that we intend to maintain the same commitment to use our net income each year for technology, hiring more people, continuing educational programs and, starting this summer, hiring interns from our local business schools to groom the next generation of advisors as well as new construction to expand the office for additional employee work stations...