Peak in Global Infection Rate

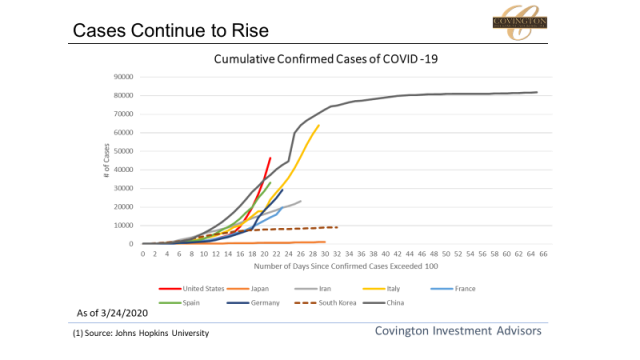

Worldwide infection numbers continue to grow as most of the world remains in shutdown. The service sector has been especially badly affected, with consumer facing industries bearing the brunt of the social distancing measurements. Although domestic health centers are strained, they have not been overrun such as those in Italy or Wuhan, China.

It’s not all doom and gloom, positive signs are popping up in pockets across the world.

In an encouraging sign, Italy has reported three straight days of new cases below the peak of 6,557 which occurred on March 21st. Saturday was 16 days since Italy took more drastic measures of social distancing such as shutting schools, universities, and non-essential businesses. China reached peak reported numbers 12 days after taking such measures. This would mean that we can use this 12-16 day window as a rough guide for a peak in the United States after most of the country was shut down, which was March 14th. This would indicate that US daily new cases should see the worst levels Thursday through Monday of this week and then begin to flatten out. Of course, as we have previously mentioned, all countries are handling this virus outbreak differently.

Trough in Manufacturing Indexes

Although domestic manufacturing numbers have not yet been reported, we can use services numbers as an estimate since they historically track each other fairly closely. As can be estimated, economic data will not be pretty as almost all available data being consistent with measures that would indicate we are currently in a recession. Although most of this is already priced into the market there are still many unknowns which will need to be shaken out over the next few quarters.

Government and Monetary Response

We also now have more clarity on monetary and fiscal response. On the monetary side, the Federal Reserve has made clear that they will do whatever it takes to maintain liquidity in the fixed income market by expanding their balance sheet. For the first time they have not put a dollar limit on this support but rather an open ended purchase agreement. The long-term effects of this policy will need to be foreseen but in the short term this is essential for ensuring liquidity does not dry up.

On the fiscal side it appears that lawmakers have finally come together on an emergency economic stimulus package. From first glance this plan provides roughly $2 trillion to jolt the economy and prop up businesses through the crisis. This aid package includes business loans, expanded unemployment insurance, and direct cash payments to many Americans affected by the Coronavirus shock.

Disclaimer: The information contained in this commentary has been compiled by Covington Investment Advisors, Inc. from sources believed to be reliable, but no representation or warranty, express or implied, is made by Covington Investment Advisors, Inc., its affiliates or any other person as to its accuracy, completeness or correctness.

Under no circumstance is the information contained within this correspondence to be used or considered as an offer to buy or sell or a solicitation of an offer to buy or sell any particular security. Nothing in this correspondence constitutes legal, accounting, or tax advice or individually tailored investment advice, or research. This material is prepared for general circulation to clients, and does not have regard to the particular circumstances or needs of any specific person who may read it. The recipient of this correspondence must make his or her own independent investment decisions regarding any securities or financial instruments mentioned herein. Past performance is not indicative of future results. To the full extent permitted by law neither Covington Investment Advisors, Inc. nor any of its affiliates, nor any other person, accepts any liability whatsoever for any direct, indirect or consequential loss arising from any use of this market commentary or the information contained herein. This correspondence may not be reproduced, forwarded or copied by any means without the prior consent of Covington Investment Advisors, Inc.

Investors should review this correspondence knowing that any comments and opinions made in this correspondence are subject to change and positions held by the authors may be sold.