Market Rotation

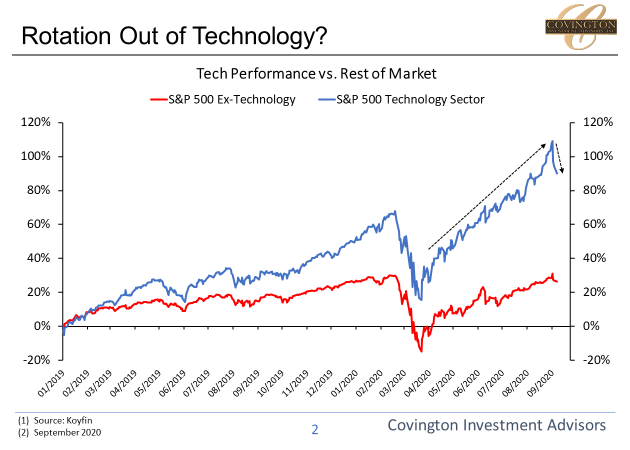

A historical blend of events in 2020 including the COVID-19 pandemic, shift to a work-from-home economy, and record low interest rates, created the perfect storm for large-cap US tech to structurally outperform the broader market. This outperformance has reversed in recent days with the S&P 500 falling 2.27% and the tech-heavy NASDAQ falling 3.25% last week. This sell-off might have been unavoidable given how stretched some of the valuations for the headline growth names have become relative to their historical ranges and profits began to be taken. It is difficult to see how operationally these tech companies will not continue to benefit as they have for so long, but in the near term a “catch up” rotation could be taking place in the market as the reopening of the economy accelerates, and those industries that have been decimated revert to the mean. In our previous blog post "Air Traffic Data Update" we highlighted how some industries were not seeing a stable recovery and that polarization still remains true today. However, recent economic data has come in better than expected boding well for those depressed industries to at least slightly ‘bounce’.

Timing a switch away from an area of the economy that has performed so well to those weakened alternatives is difficult. Still, an eventual mean reversion among valuations across the market is inevitable. Central Banks around the Globe have purchased over $1 Billion of financial assets every hour since the government lockdowns in March. This massive stimulus has coincided with a $1.5 billion increase in the Nasdaq 100’s market cap every hour. As long as this primary support pillar remains intact, owners of financial assets will continue to be the primary beneficiaries of monetary stimulus.

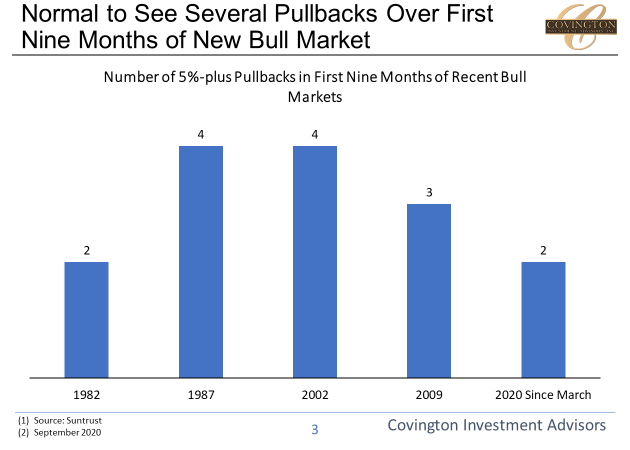

In the near term, a pullback after the S&P 500 has rallied more than 50% from its March lows is to be expected. Since the rebound from the March lows there have only been two pullbacks of more than 5% . Recent bull markets have tended to have 3 or 4 in the first nine months. Therefore, we are likely to see at least one more sell off before year-end which makes perfect timing for the 2020 election season volatility.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.