In anticipation of heightened volatility, I wanted to touch base with you as I see the current economy and markets at an inflection point. Year to date global equities have continued their strong momentum from last year with many indices posting double digit gains so far in 2021. The S&P 500, the market index comprising of the largest US companies, has notched over 40 closing all-time highs in 2021 with one of the strongest recoveries coming out of a recession on record.

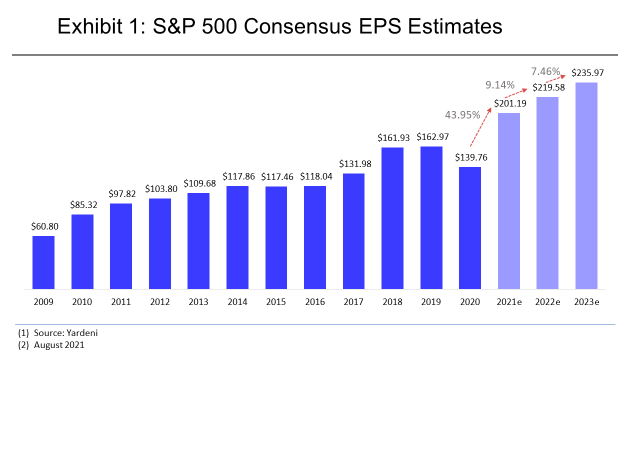

If you recall, early in this market rally from the March 2020 lows the central narrative surrounding the economy was that markets were disconnected from fundamentals and thus ripe for a “double-dip” sell-off. This did not end up being the case as economic data on almost every front has come in stronger than expected and 2021 corporate earnings are projected to come in 21% higher than 2019 levels. In fact, economic data has come in so strong that now inflation and overheating are a central risk to markets. And while the virus is still moving throughout the world, the vaccine rollout continues to progress, and the world is reacclimating to daily life.

Volatility has also been relatively tempered as the S&P 500 has gone over 200 days without at least a 5% drawdown from its peak. This market action has historically been an exception, not the rule.

But just as markets were pricing in the future economic fundamentals since last March, it is important to keep an eye down the road for what is coming. Looking forward from today I believe we are reaching an adjustment period as the economy moves off of peak earnings growth, economic growth, and fiscal & monetary stimulus. Real GDP year-over-year growth is likely to peak this quarter at 12.2% and then moderate in coming years into the normalized 2-3% range. Correspondingly, corporate earnings growth will moderate from 44% year-over-year in 2021 to 9% next year, and 7% the following year.

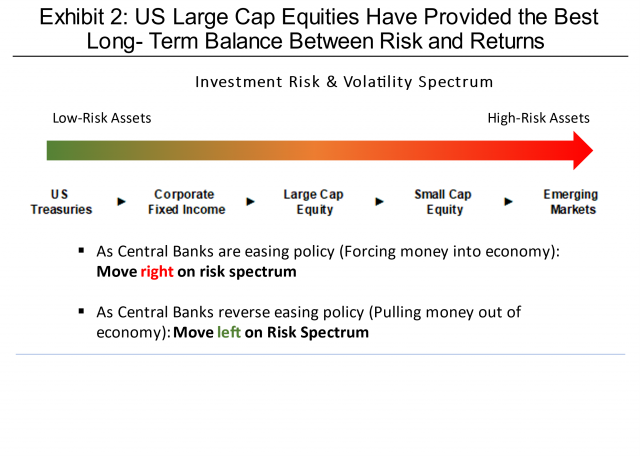

Furthermore, fiscal and monetary support has been an omnipresent theme in markets for the last two years and that has persisted with the Fed continuing to buy $120 billion worth of securities a month. In the last six quarters, the combined balance sheets of the four main central banks have expanded by approximately $9 trillion. On the fiscal front, the government remains adamant about supporting citizens along with passing an infrastructure bill. However, rising inflation and strong economic data are forcing the Central Bank to contemplate pulling back some of this support and we predict that Fed Chairman Jerome Powell will announce a tapering of the Fed’s asset buying program this week at the Annual Jackson Hole Conference.

We are entering an environment where economic and earnings growth will still be positive in the coming quarters, but at a slower, more normalized rate. Additionally, central bank policy will remain accommodative as interest rate hikes are still a long way off but not as accommodative as since last March. This “peak growth” phase in the economy typically coincides with still positive returns in markets, but increased volatility as the market transitions from rapid growth coming out of a trough like last March.

I want to reinforce why our asset allocation and investing philosophy is well positioned to move into this new phase. Our investment holdings have always been anchored by large, dividend-paying companies that have weathered several economic cycles. These proven enterprises have shown to be the most dynamic and adaptable entities over not just recent cycles, but for decades. In addition to providing attractive returns, these companies have done so without taking on the additional risk that comes with venturing into private or emerging markets. And when the market goes through periods of volatility or turmoil, the cash flow generated from these holdings carries the day.

When it comes to the fixed income portion of the market, we remain overweight equities as a myriad of factors, including central bank operations, have pinned interest rates at all-time lows. The equity market now offers better cash flow dynamics than the bond market along with diligently growing those dividends over time which also plays a significant factor in the overweighting of stocks. Within the fixed income allocations, we remain selective by holding high-quality, short duration bonds with favorable credit ratings.

While we may not be able to perfectly predict the future, we can make sure that we are prepared for inevitable change in the world and in markets. Although I still see the long-term fundamentals moving in the right direction for the economy, as we move into the end of the year, I want to emphasize our position while making sure we are sticking to our long-term financial plan. That includes having 12 months of operating cash set aside to ensure investments do not need to be liquidated at an inopportune time in the event that market volatility ensues.

Let me know if you would like to schedule a time to meet and discuss these matters further.

Warmest of personal regards,

Pat