Acceleration of Ecommerce

When a pivotal economic event takes place like we are experiencing with the coronavirus pandemic there are certain trends that begin to either arise or quickly accelerate. We think the latter is currently happening with Ecommerce. It is no secret that for many years online shopping has been taking market share from brick and mortar retail. But never before have we seen a scenario where many brick and mortar retails were forced to close shop and deemed “non-essential”, while the large online market places became the essential way for consumers to get the goods they needed. Some could argue that Amazon & Walmart, the two largest Ecommerce retailers, became a staple of national security for their distribution capabilities as citizens are quarantined in their homes.

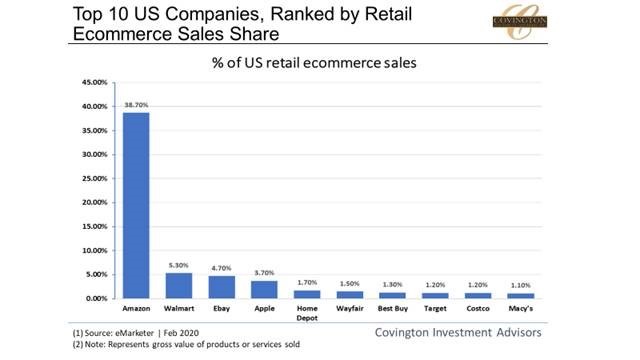

Much of this gained business is due to many small retailers simply being forced to close for several months, but we think that Ecommerce retailers will keep a good portion of the gained customers even after government shutdowns are lifted. In late April during Microsoft’s Q3 earnings call, CEO Satya Nadella remarked that “We have seen two years’ worth of digital transformation in two months” as Microsoft provides part of the digital infrastructure that Ecommerce retailers use. The graphics below show the dramatic penetration that online sales have reached along with the industry distribution due to this new world of the government forcing citizens to stay in their homes.

The government shutdowns have also highlighted the “haves & have nots” in the economy. Many small businesses will struggle to compete with large retailers that have the logistics and resources to sell their products online to a worldwide customer base. Even non-technology/retail businesses are rushing to adapt their businesses to the digital age. We believe our bias towards large-cap companies is well positioned to capture the economic benefit of this trend as we think of our companies as leaders in their respective segments/industries with the resources to adapt to this changing environment.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.