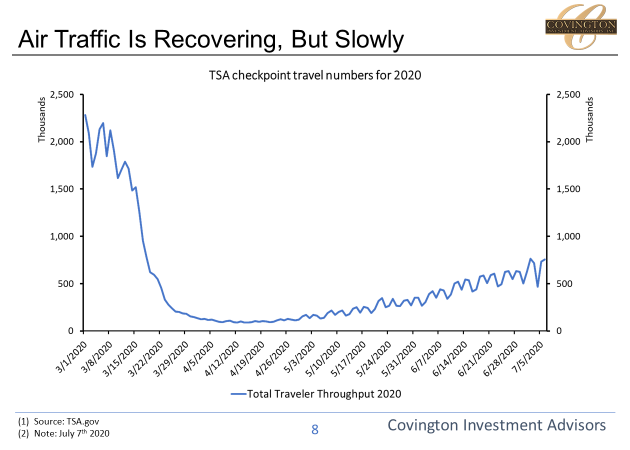

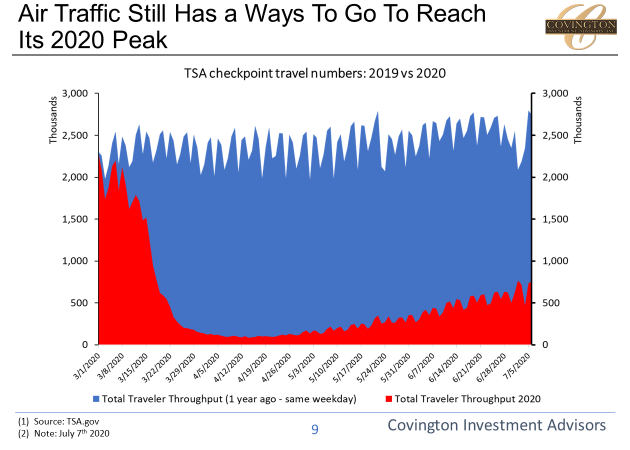

Certain industries/pockets of the economy are seeing a quicker recovery than others. The TSA keeps track of the amount of passengers originating trips from US airports. On a normal day in March that number is over 2 million, at the height of government shutdowns this year it was less than 90,000. Recently air traffic has recovered with daily passengers in the last week eclipsing 700,000, but this is still a long ways off from a “V-Shaped” recovery in air travel. Keep in mind airlines have high fixed costs, large amounts of overhead, and razor thin margins. Most airlines are simply not solvent if air travel is less than half normal traffic for a prolonged period of time.

We think this polarization in recoveries from one industry to another will continue and even worsen the longer the virus lingers in the economy. Some industries are seeing enormous demand tailwinds (Cloud, Ecommerce, Staple Goods) while others are still trying to claw their way back (Travel, Lodging, Restaurant Dining).

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.