After 18 months of very little volatility a cascading series of events including the escalation between Russia and Ukraine have reverberated throughout markets causing our first 10% percent drawdown in large cap stocks since March 2020. I'm not going to try to predict the path of military actions in Europe but I can try to put into perspective what the economic impact might be from what's taking place in the region.

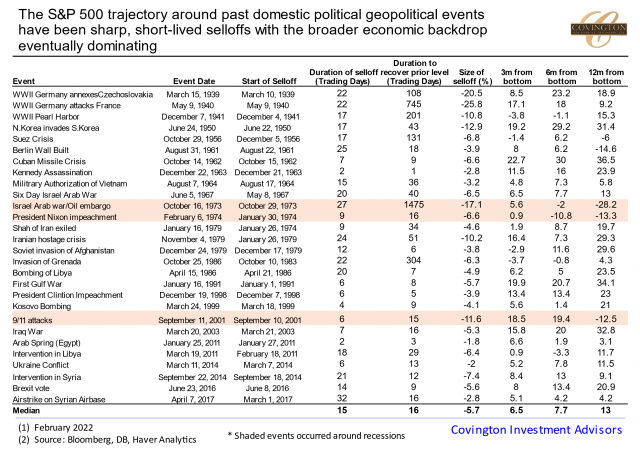

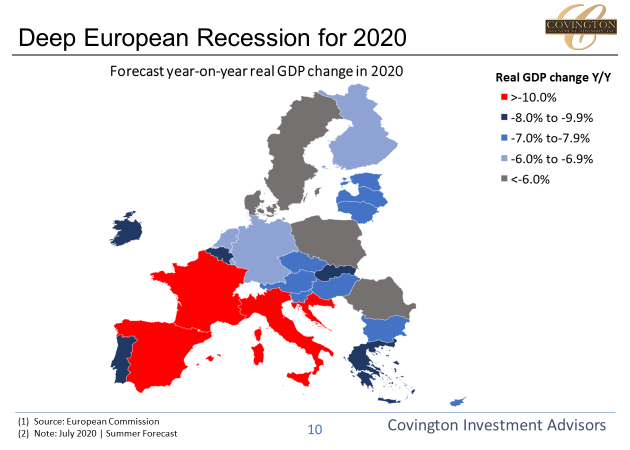

Geopolitical events by their nature are difficult to predict and tend to be short lived, although there are certainly exceptions.Outside of the commodities sector, Russia is a marginal player in the world economy accounting for only 1.3% of global GDP, and Ukraine makes up an even smaller portion. US exposure to Russia in terms of total trade is a very low 0.1% of GDP. The EU on the other hand sources roughly 1.5% of their total goods trade with Russia. The main exposure is that commodities are a global market with Russia accounting for about 10% of global oil production and the EU has become ever more dependent on imports for energy. EU imports have long represented over 90% of its oil consumption, while the natural gas import share has increased from roughly 50% in 1990 to also over 90% today. By contrast, the US has moved from importing over 50% of its oil & petroleum during the 2000s to being a net exporter today. So in theory the first order effect from rising energy prices should be modest to the overall US economy. Still, the second order effects of a shock to the already tight global energy market is what could be disruptive...

..

..

..

..

..

..