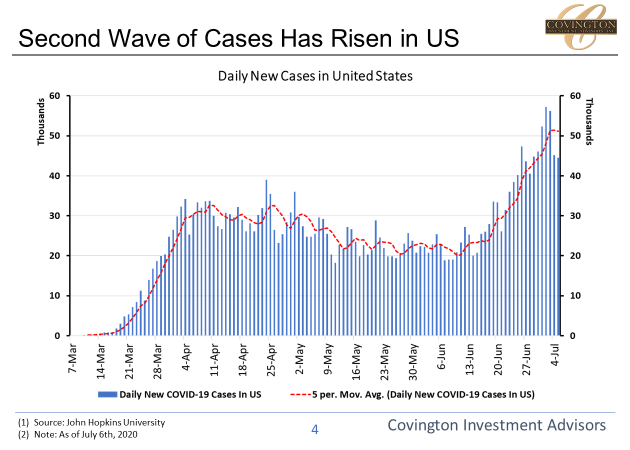

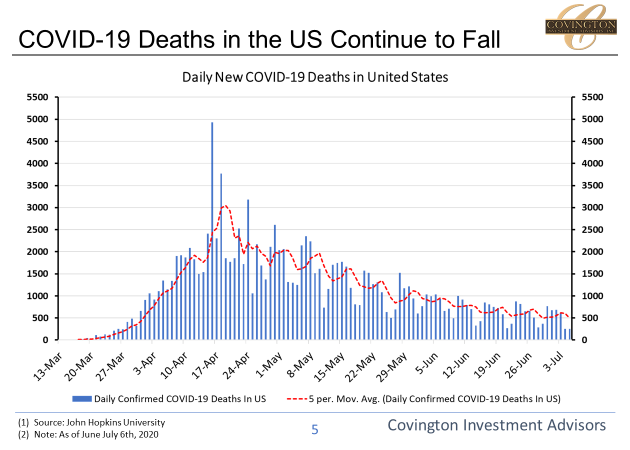

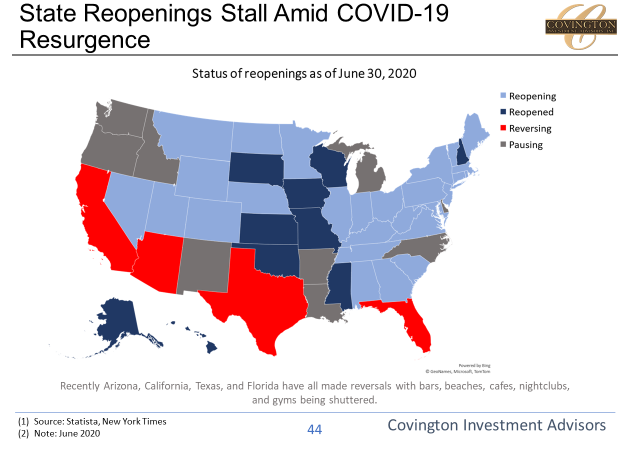

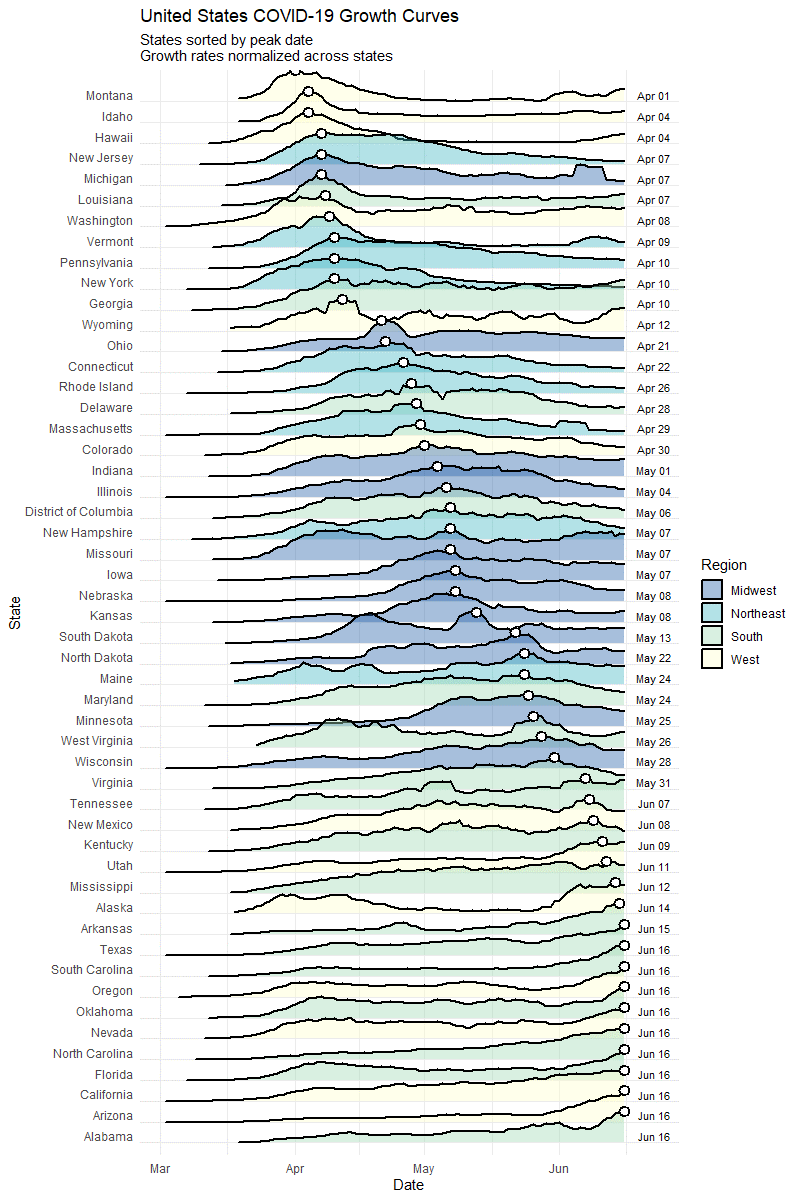

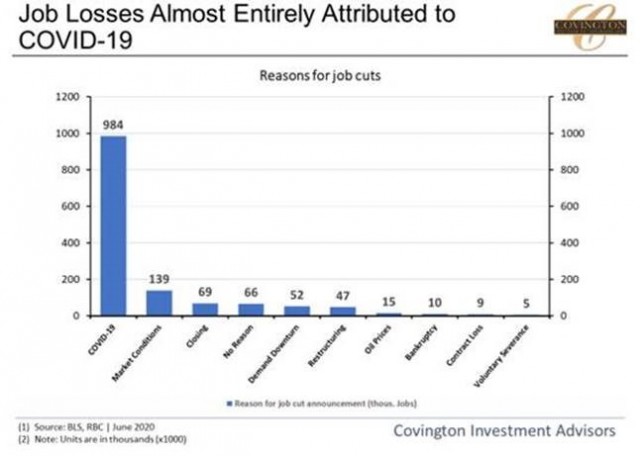

Cases fell slightly from their peak over the weekend but still remain high, particularly in the new “hot spot” states (Arizona, Florida, Texas). Many of these states have now imposed stricter social distancing guidelines after remaining relatively open during the pandemic. Even after 10+ days deaths have still not followed the increase in case load. The lag time window is not an exact number of days but this is still encouraging.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment...

..

..

..

..

..

..

..

..

..

..