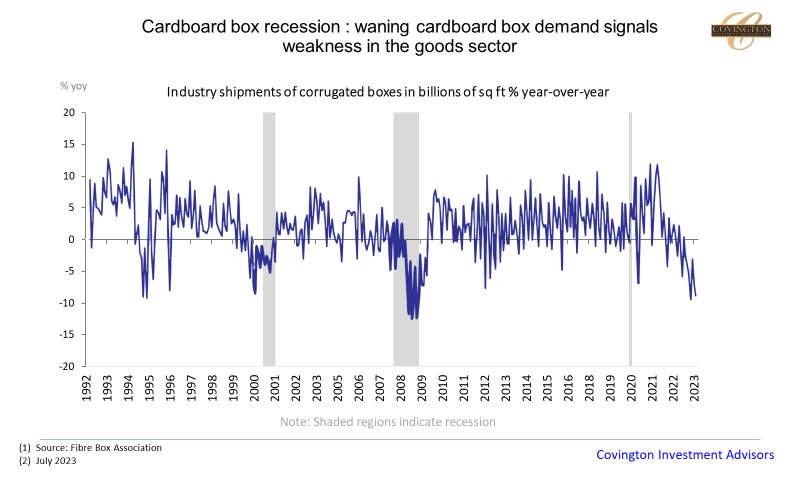

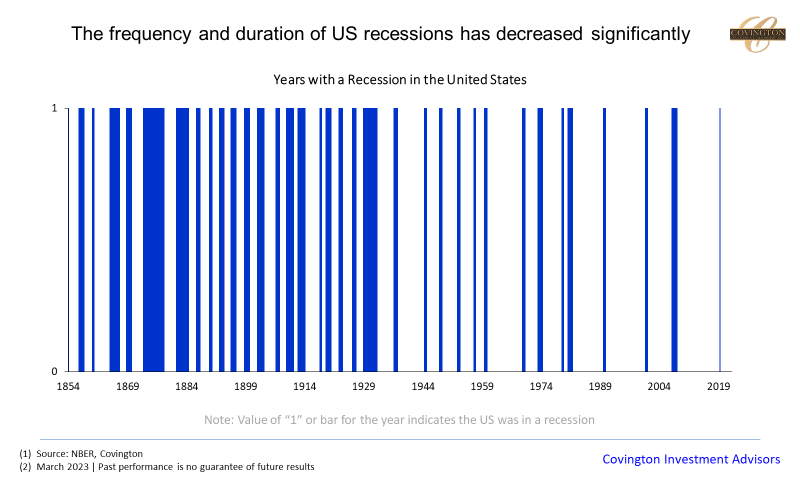

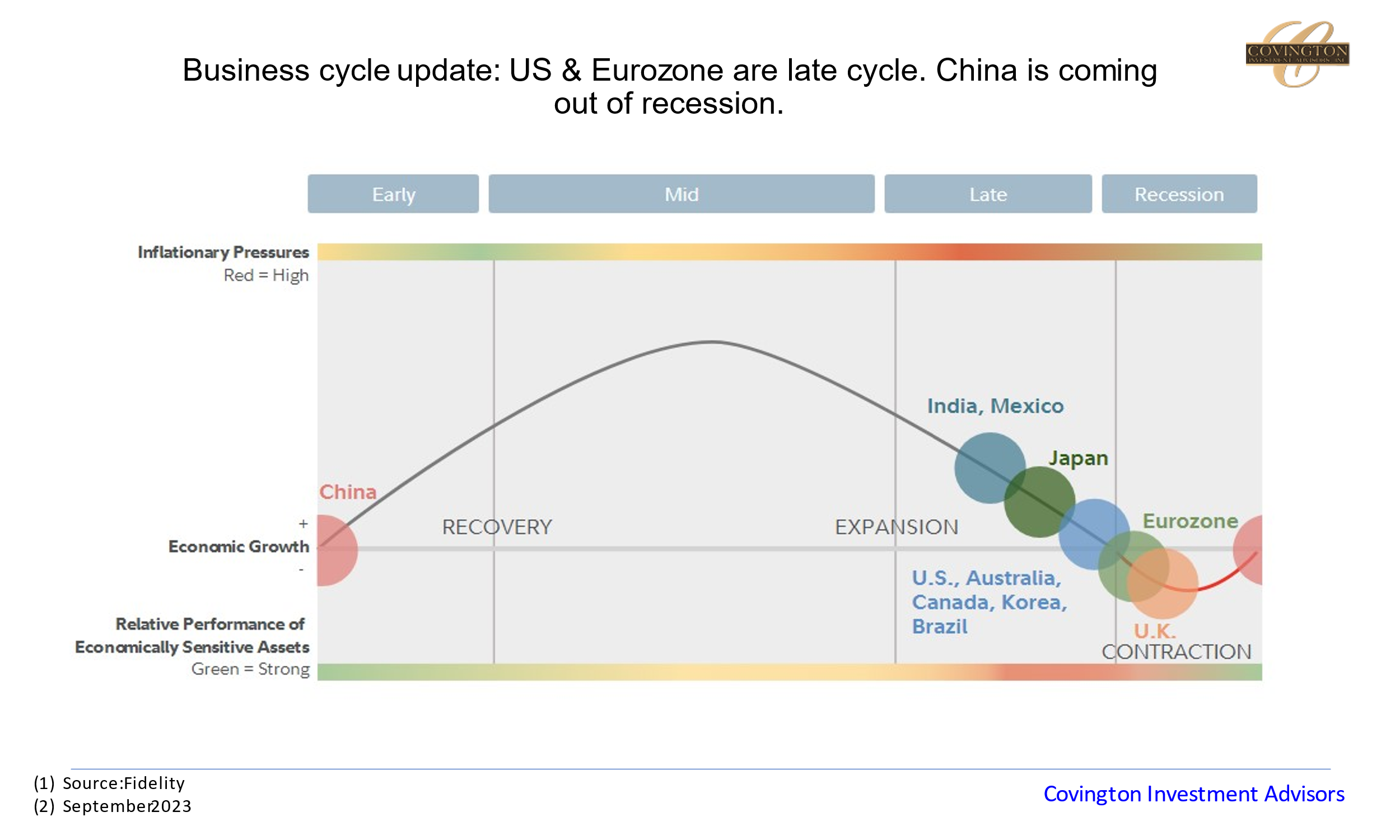

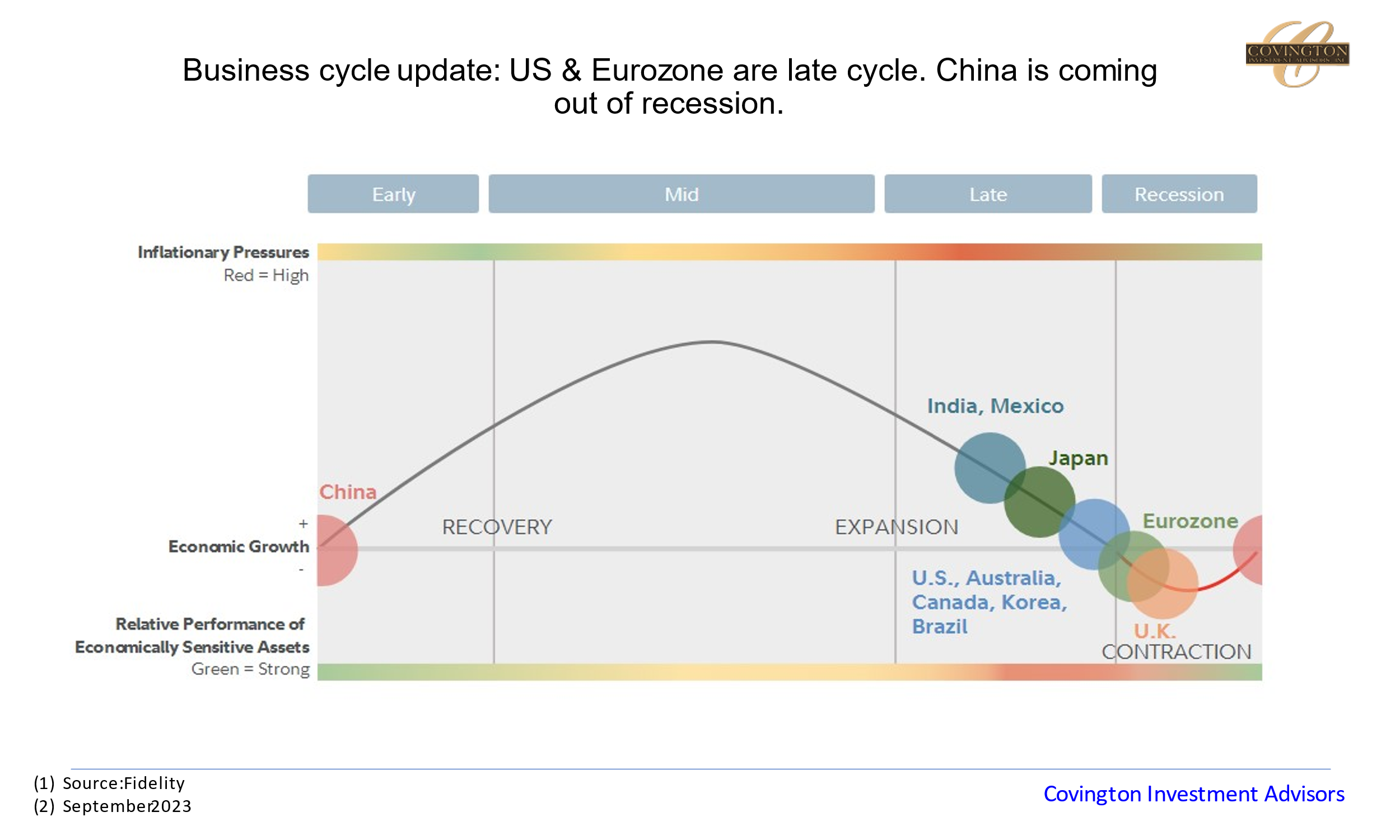

The US economy is currently in the late cycle of an economic expansion where economic growth is slowing, but it is still positive. This phase is typically characterized by rising inflation, tighter monetary policy, and increased volatility in the stock and bond markets, all of which you have seen over the last two years. We have been warning of this as several indicators have begun to point towards the US being in late cycle and many signaling the US entering a recession in the next 12 months. The root cause of these developments has been the fed’s monetary policy of raising rates to mitigate the impact of higher inflation.

The US economy is currently in the late cycle of an economic expansion where economic growth is slowing, but it is still positive. This phase is typically characterized by rising inflation, tighter monetary policy, and increased volatility in the stock and bond markets, all of which you have seen over the last two years. We have been warning of this as several indicators have begun to point towards the US being in late cycle and many signaling the US entering a recession in the next 12 months. The root cause of these developments has been the fed’s monetary policy of raising rates to mitigate the impact of higher inflation.

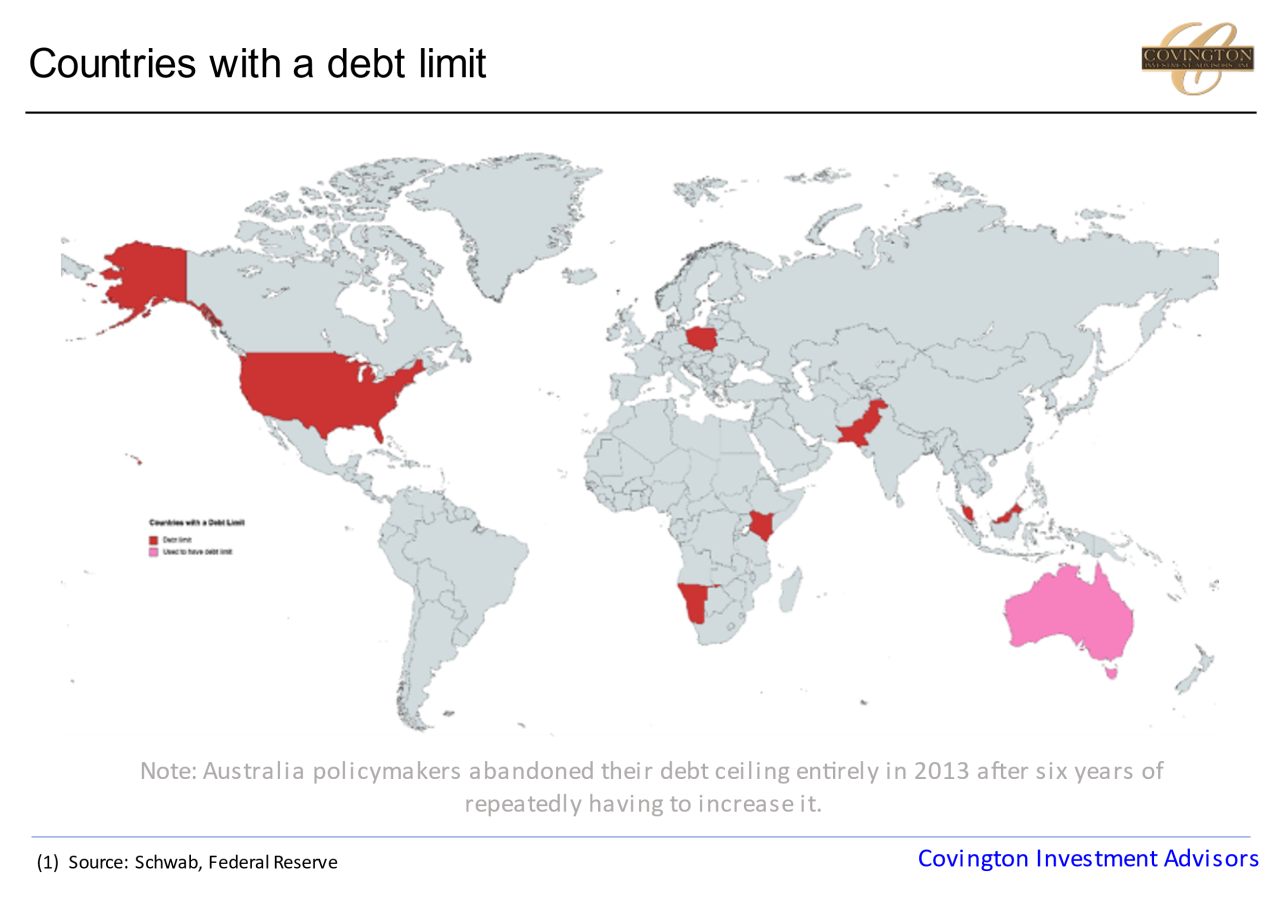

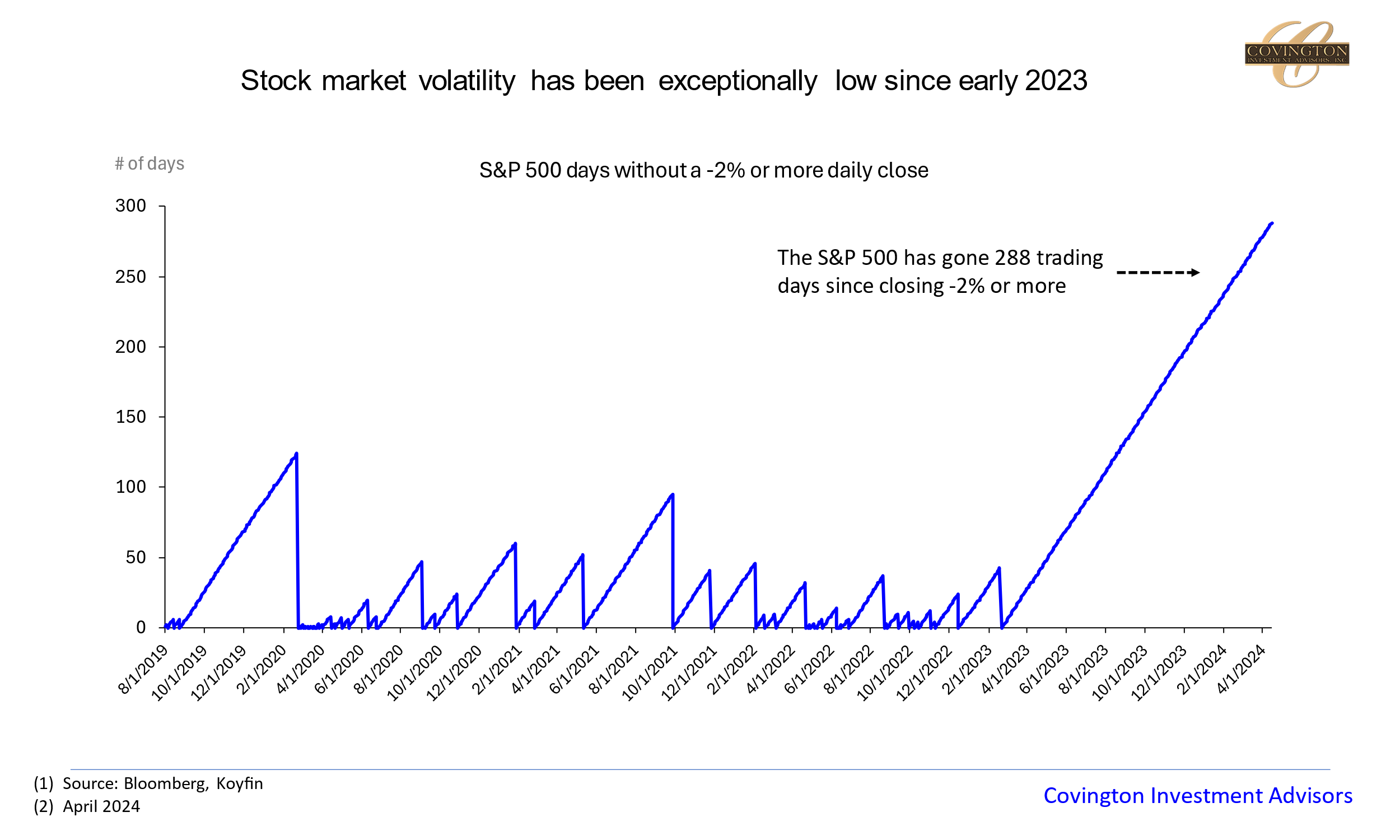

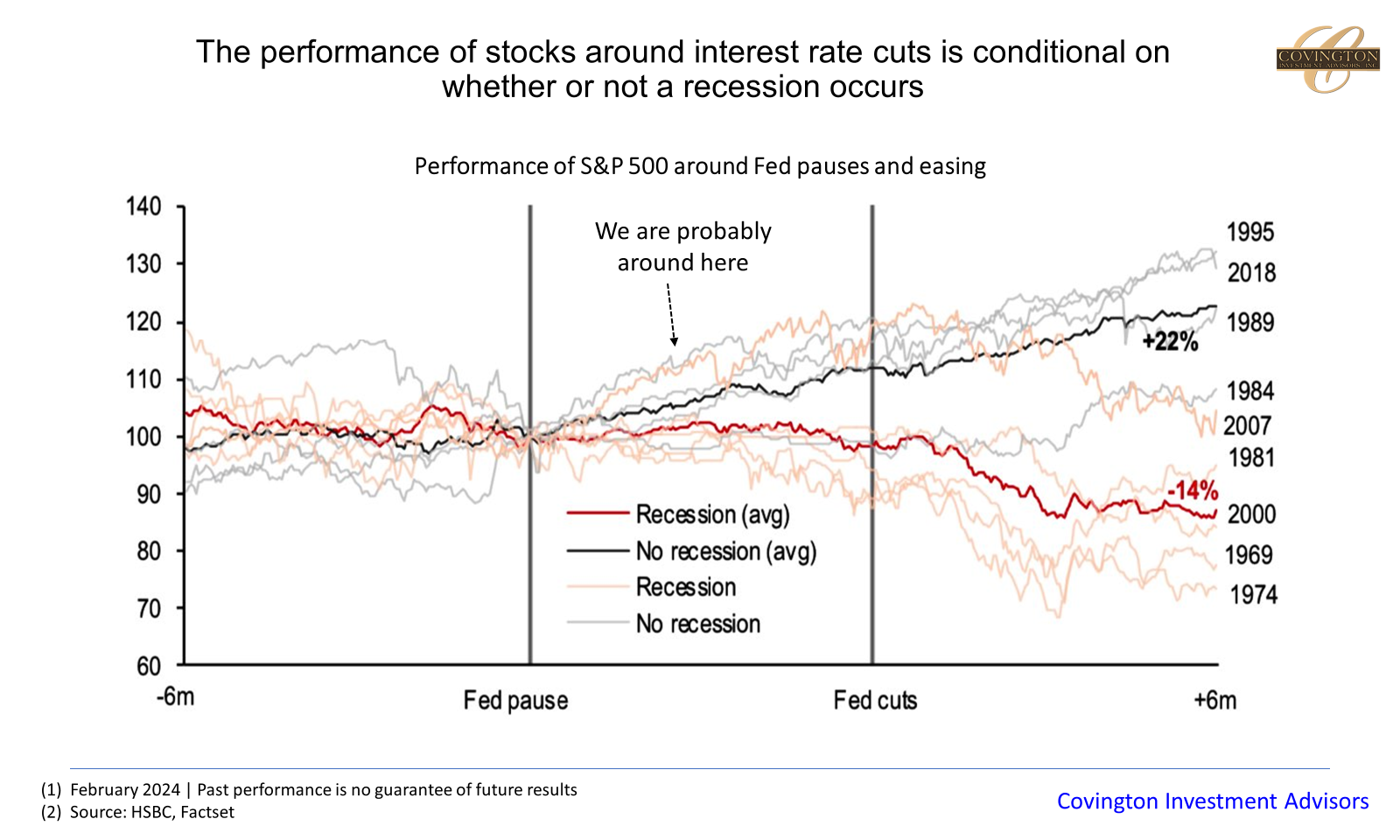

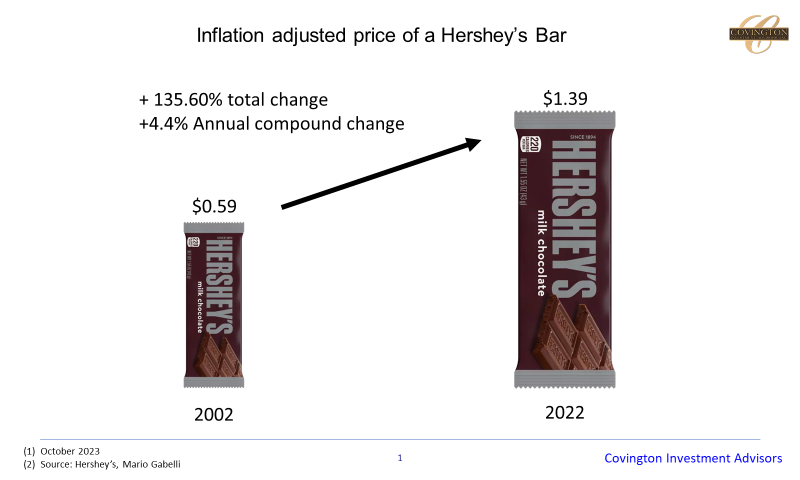

In the face of rising inflation, the Federal Reserve has embarked on their most aggressive rate hiking cycle in decades which will eventually slow down the economy. On the other hand, record low unemployment, large fiscal deficits, and strong household balance sheets have buoyed the economy and markets. But still, looking ahead, every time the Fed has embarked on a tightening cycle, an economic slowdown has followed, and with it, market volatility. However, the unusual nature of this post COVID cycle has distorted the normalization of rates and its impact on the overall economy. Even though the timing of this economic cycle may be different from past cycles, the principles for managing it remain the same.

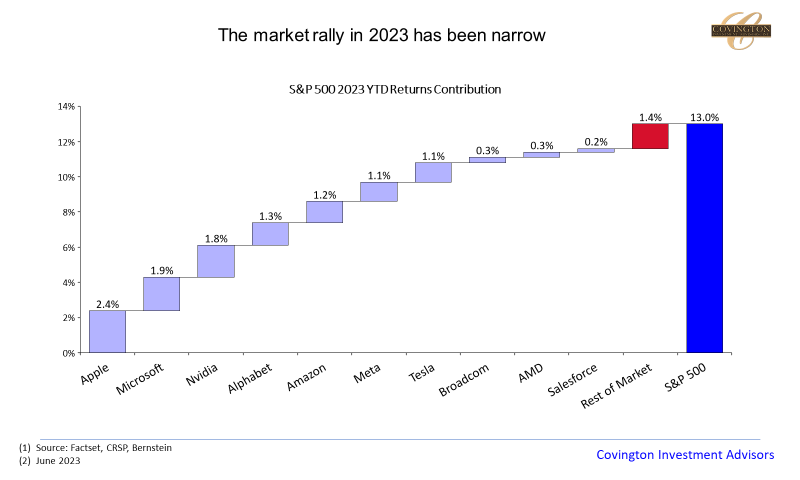

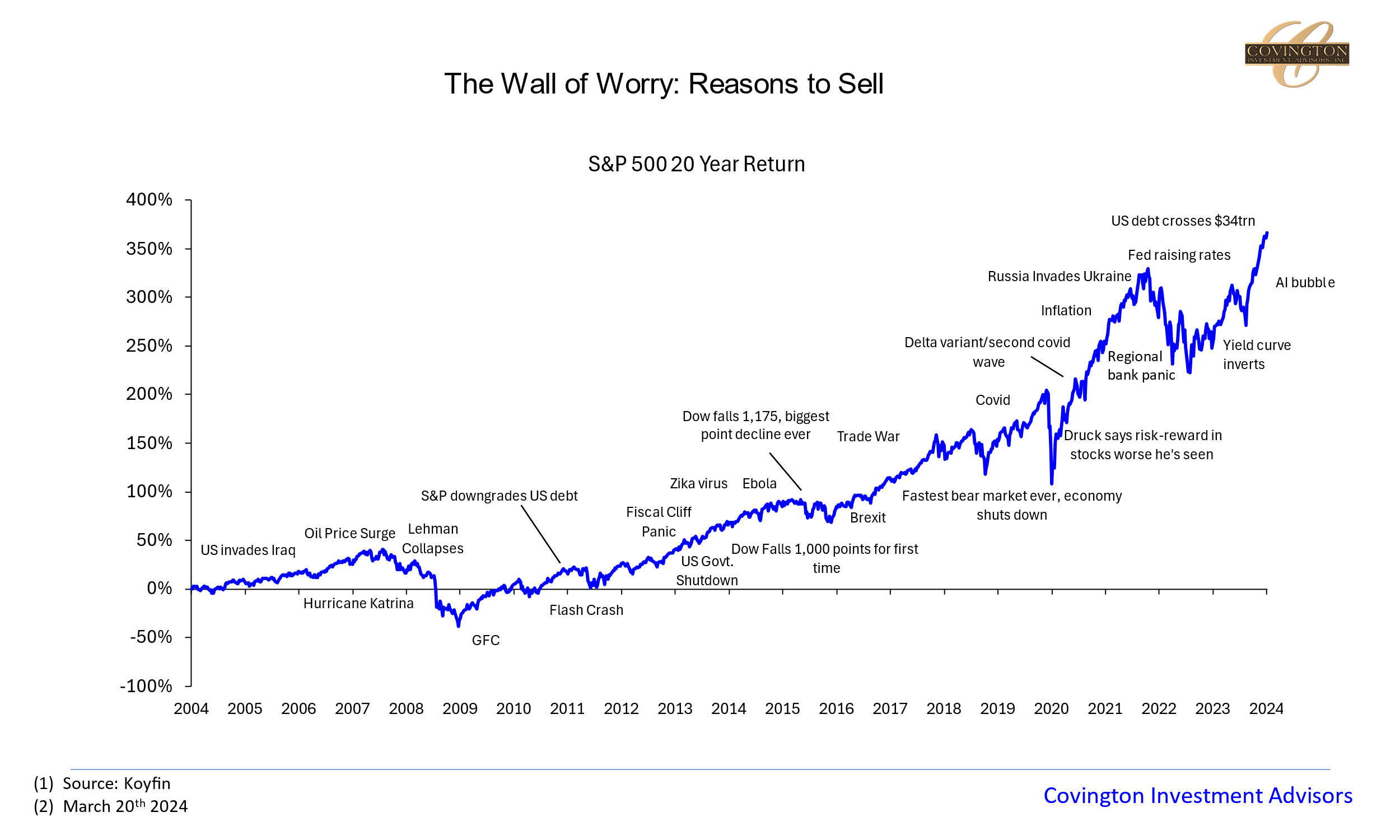

Part of our job as your advisor is not only managing assets but managing emotions. Markets by nature are unpredictable because ultimately it is people that are transacting assets. We have commented before on the “manic depressive” nature of investors whereas they become too fearful close to the bottom and too euphoric close to the top. This creates both difficulties and opportunities. The difficulties come because it is never pleasant to weather a sell-off and see negative numbers. The opportunities come because extreme pessimism during selloffs is what gives investors opportunities to deploy capital into assets at attractive prices below their intrinsic value. This can come in the form of excess cash, dividend reinvestment, or companies themselves deploying retained earnings. This also hinges on owning a diversified portfolio of proven enterprises that have strong balance sheets and provide cash flow to shareholders even through the trough of market cycles. This has always been our bias...

The US economy is currently in the late cycle of an economic expansion where economic growth is slowing, but it is still positive. This phase is typically characterized by rising inflation, tighter monetary policy, and increased volatility in the stock and bond markets, all of which you have seen over the last two years. We have been warning of this as several indicators have begun to point towards the US being in late cycle and many signaling the US entering a recession in the next 12 months. The root cause of these developments has been the fed’s monetary policy of raising rates to mitigate the impact of higher inflation.

The US economy is currently in the late cycle of an economic expansion where economic growth is slowing, but it is still positive. This phase is typically characterized by rising inflation, tighter monetary policy, and increased volatility in the stock and bond markets, all of which you have seen over the last two years. We have been warning of this as several indicators have begun to point towards the US being in late cycle and many signaling the US entering a recession in the next 12 months. The root cause of these developments has been the fed’s monetary policy of raising rates to mitigate the impact of higher inflation.