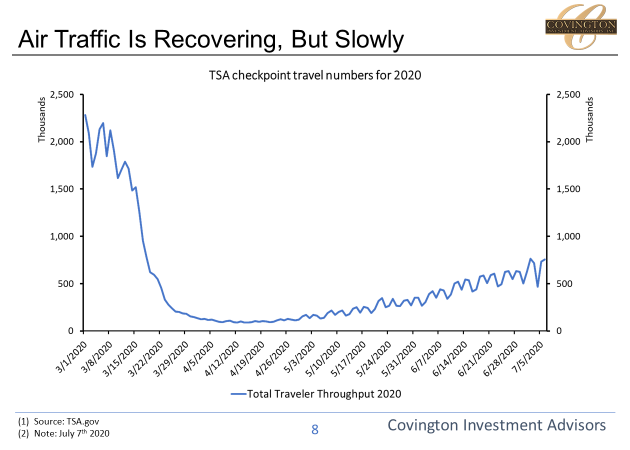

Certain industries/pockets of the economy are seeing a quicker recovery than others. The TSA keeps track of the amount of passengers originating trips from US airports. On a normal day in March that number is over 2 million, at the height of government shutdowns this year it was less than 90,000. Recently air traffic has recovered with daily passengers in the last week eclipsing 700,000, but this is still a long ways off from a “V-Shaped” recovery in air travel. Keep in mind airlines have high fixed costs, large amounts of overhead, and razor thin margins. Most airlines are simply not solvent if air travel is less than half normal traffic for a prolonged period of time.

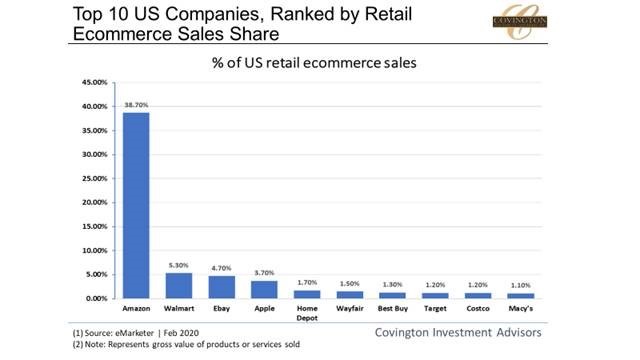

We think this polarization in recoveries from one industry to another will continue and even worsen the longer the virus lingers in the economy. Some industries are seeing enormous demand tailwinds (Cloud, Ecommerce, Staple Goods) while others are still trying to claw their way back (Travel, Lodging, Restaurant Dining).

..

..

..

..

..

..

..

..

..

..

..

..

..

..