Debt Ceiling Deja Vu

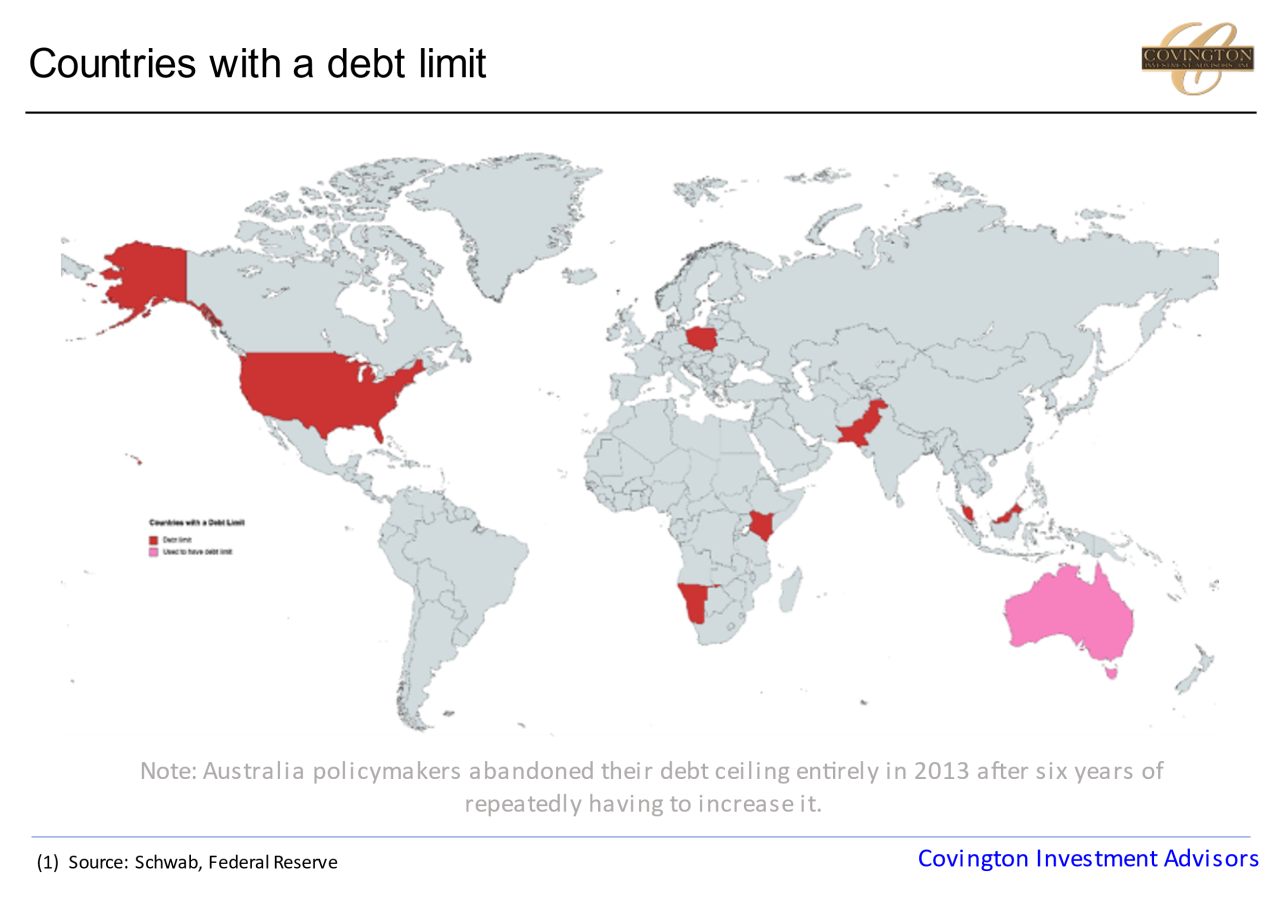

Not quite as salient in markets as inflation, but certainly occupying the headlines has been the pending battle on raising the debt ceiling. Congress has always placed restrictions on federal debt. These limitations have helped Congress assert its constitutional powers of the purse, of taxation, and of the initiation of war. Since WWII, Congress has raised the debt limit 78 times and suspended it another five times. For most of the post-war period debt limit increases were considered routine legislative chores that never engendered much debate or public scrutiny. The current debt limit of roughly $31.4 trillion was reached this quarter prompting the discussion to begin on raising the debt limit in order to maintain the country's spending habits. You'll remember we went through a similar episode in 2021 when the debt limit was reached and subsequently raised but only by enough to prevent a default until the beginning of this year - Thus here we are now having the current debate.

A deeply divided congress still has five or six months to reach a deal on raising the limit and avoiding a default or funding delay in the US treasury market, which is an integral component in the global financial system. Both sides are dug in early with Republicans saying they won't agree to a debt limit increase unless it accompanies spending cuts (although most spending appears to be off the table). Democrats say they will only support a debt limit increase without cuts or other changes. You'll remember in the 2021 episode which we wrote about at the time (here), both sides of congress used the element of political brinkmanship which rattled investors. This involves waiting until the very possible last moment, but ultimately hammering out a deal because they realize the consequences of not doing so would be catastrophic. We never like to assume, but feel that the situation this time around will play out similarly. For politicians there is no reason not to take things right down to the wire like they did in 2021. A government shutdown might even take place which does not affect markets much if it only lasts a few weeks.

The bottom line is that we expect a barrage of headlines regarding the debt ceiling debate but minimal effects on markets unless something new and worse happens.A government shutdown that lasts a few weeks should not be a major shock, but a longer shutdown or a debt ceiling violation would likely be a big deal. By 3Q, the Treasury is expected to run out of gimmicks to get around the debt ceiling. Still, the fact that talks about a resolution are taking place several months ahead of the default deadline should be a positive sign.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.