Deflation in 2020/21. Inflation in 2022 … Stagnation in 2023?

During the covid lockdowns starting in 2020 deflation dominated markets as economic velocity and prices plummeted. US treasury yields fell to an all-time low bumping under 0.5%, growth stocks soared, and speculative phenomena such as NFTs and crypto went mainstream. During this time the US tech sector market cap rose to over $7 trillion.

But in the background you had central banks and governments working to stimulate the economy out of the pandemic and in the second half of 2021 came the hottest inflation in 40 years. US CPI ramped from 0.1% in May ‘20 to 9.1% by June ‘22 with commodity centric stocks like energy companies doubling in 15 months and turning the tables on technology stocks.

So that's the context of the past 3 years, but what's important now is what will this year look like. As touched upon in our recent “Dis-Inflation Fixation” note, we feel the market whiplash could be intra year as 2023 shapes up to be a tale of two halves. The first half will be characterized by the market finding solace in falling inflation as the economy meanders back to a 2% inflation level over the next two years (see chart above). As I'm writing this the markets are digesting January's inflation reading which came in at 6.4% year-over-year and 0.4% month-over-month. Markets have also celebrated the Fed's downshifting of interest rate hikes to 25 basis points signaling they are near the end of their planned tightening cycle.

But I think the second half of 2023 is setting up to be different as markets seem complacent of a “second surge” of inflation akin to the 1970s and post-WWII. Services inflation and the labor market have yet to cool and we may be setting up not necessarily for a second ramp like in 1978, but that CPI gets stuck at around the 4-5% range. I still think this 1970s scenario is unlikely, but what may be more imaginable is the Fed's rate hikes slowing corporate earnings growth. In 2021 and 2022 companies were struggling to fill inventories and price hikes were boosting their profitability. In the tail end of 2022 you saw that beginning to alleviate and in fact monetary policy is working as intended. Rate hikes are starting to cool the economy via three transmission channels: interest rate sensitive parts of GDP are slowing (housing, auto, capex); high multiple equity sectors are deflating because of higher risk-free rates, and signs are popping up of a normalizing, albeit stubborn labor market.

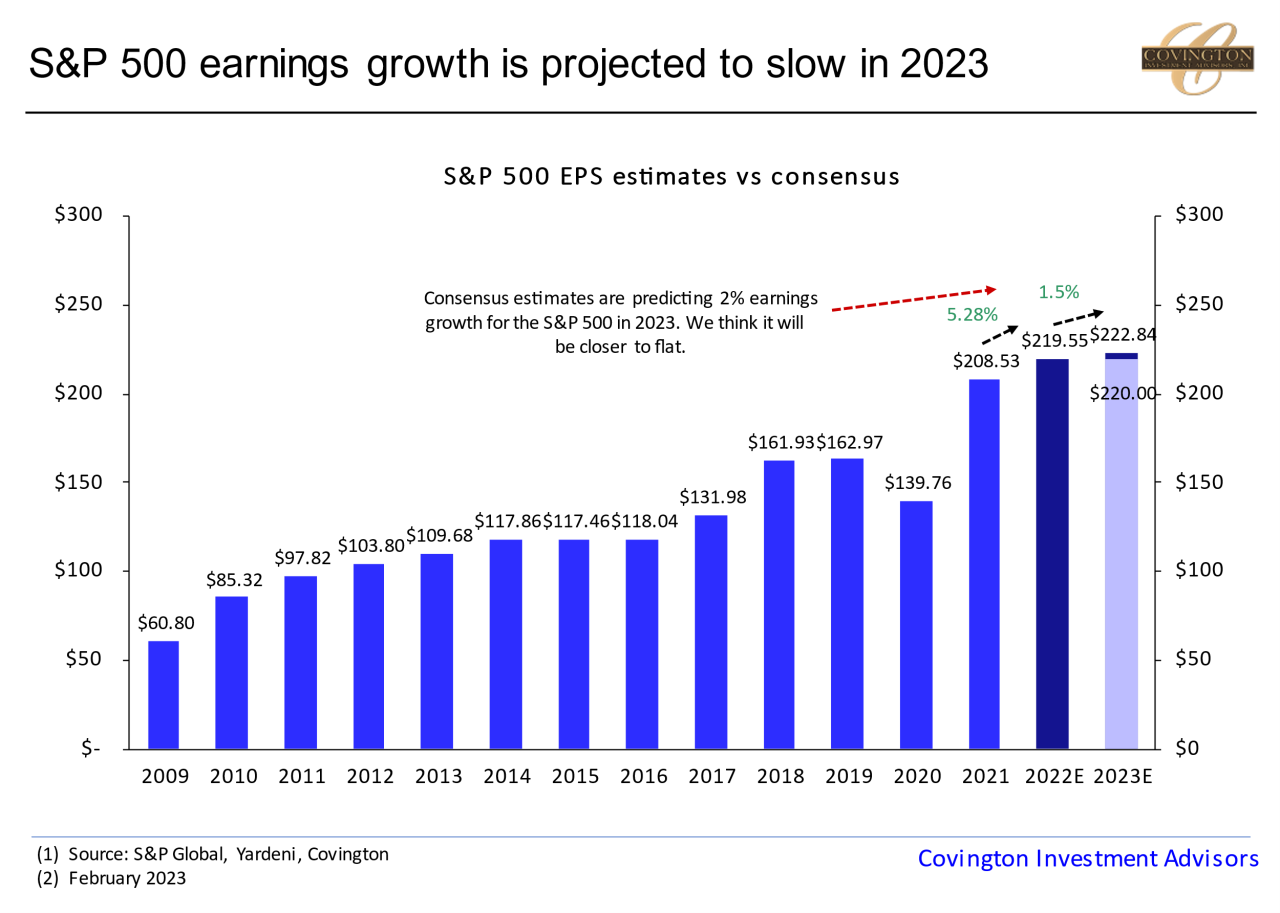

But the effect of choking off capital investment intuitively leads to a slowdown in the demand push inflation we outlined in the beginning in this note. Early last year the consensus estimates for the S&P 500 were that earnings would grow 8% in 2023. By the end of 2022 those estimates predicted that growth rate would fall to 4%. We think EPS growth for the S&P 500 will be flat for this year and consensus estimates have come down in line with that.

And usually what corporate earnings are projected to do, the market follows. To use a metaphor, markets are crossing a road and fixated on watching the inflation car pass from one side of the street, but in the second half of this year the growth slowdown car is coming in the other lane. Although I suppose an interstate highway is a more apt comparison for markets, a two lane road simplifies the linkage between growth and inflation in the economy. In short, our viewpoint is that although we have had a strong start to this year and the dissipation of inflation is a welcomed signal, a normalization of growth will make for a sideways market with elevated volatility as we head into the second half of 2023.