A few weeks ago we sent out a letter followed by a note conveying that after an exceptionally strong 18 month stretch of performance in markets with little-to-no volatility we would be transitioning into a period where market price action would normalize and volatility would likely rise. However, we still see long term equity market performance remaining strong supported by the fundamental backdrop.

That volatility came to fruition as several cascading news headlines have come down in the last week beginning when Evergrande, a large property developer in China, announced that it would likely not be able to pay its financial obligations. Evergrande is widely reported to have around $300bn of liabilities, own 1300 real estate projects in 280 cities and is associated with 3.8million jobs per year. So it’s reach is wide and because of this the fear was that it would have a bleeding effect throughout markets. Because of China's opaqueness it is really hard for outsiders to gauge what is truly happening inside the country but I can give at least my view on what the fallout from Evergrande will be. I think the Chinese government will allow Evergrande to fail but use the country's trillions in reserves to limit the contagion of Evergrande’s liabilities. This will begin with containing the domestic financial risk in China to make sure the collapse does not become systematic. However, I doubt the Chinese government will be as benevolent with foreign holders of Evergrande debt. This view is supported as Chinese high yield bond indexes spiked but investment grade indexes barely moved on the Evergrande news. This indicates that investors in adjacent Chinese debt products do not expect the contagion to escalate into a widespread credit crisis. Also, the nature of China’s centrally planned economy limits the flow of capital outside the country and Chinese investors in Evergrande expect to be reimbursed.

The next matter causing anxiety in markets is the dysfunction taking place in Washington surrounding the nation's budgetary obligations. This issue was two-pronged as a government shutdown needed to be avoided and the debt ceiling raised so as not to default on the country's loans. Half of the issue has been stop-gapped in the last few days as a continuing resolution has been passed to keep the government open through December 3rd. This is encouraging from a civic point of view although government shutdowns in the past have had little impact on financial market performance and any temporary hit to the economy is almost fully reversed with the reopening.

The debt ceiling is much more important for a few reasons. First, it threatens the full faith and trust of the credit of the US government. Trust in the treasury markets is a huge advantage for the US as it means low financing costs and capital tends to flow in, rather than out, of the US in times of crisis. This is one of the main reasons why US markets tend to be much more resilient as opposed to our foreign counterparts. Second, hitting the ceiling and running out of maneuvers to circumvent it would instantly cause a major economic shock. The main reason it has never happened is politicians know the consequences are dire.

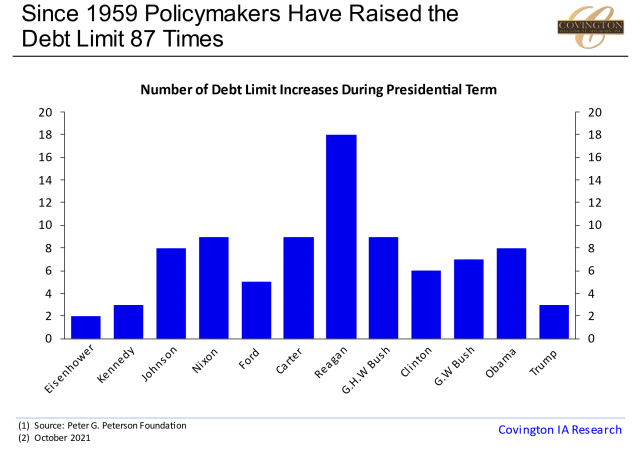

That being said, our governing body does this same spectacle every time the debt ceiling needs to be raised (which has been often).Each time politicians take it down to the final deadline in an effort to make the opposing party look bad until eventually whichever side is polling worst on the topic capitulates and a deal gets done at the 11th hour. In this case the deadline is October 18th according to Treasury Secretary Yellen so the consensus view is that a deal will get done sometime close to that date. Moreover, the political consequences of waiting until the last second are relatively small, incentivizing the political parties to try to pin the chaos on one another in the meantime.

In short, the fact that passing the budget bills in Washington is highly partisan and seems to require brinkmanship moments is painful to watch. However, the way this negotiation process is playing out is almost exactly like each prior instance. Our view is that a deal will get struck but it will come down to the wire for political reasons as it has in the past. We will monitor these events and update you as the situation progresses over the coming weeks.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.