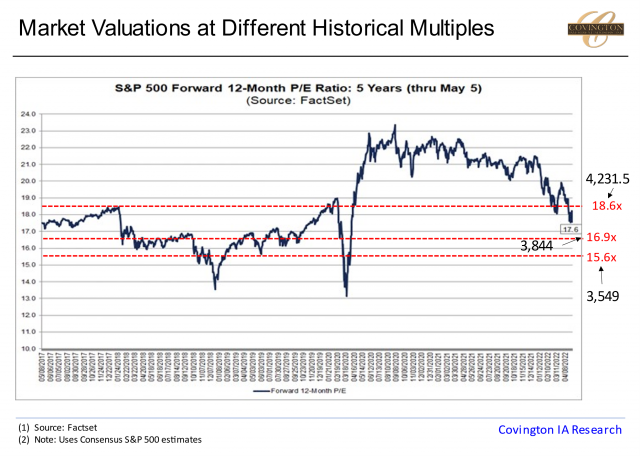

With the dramatic compression in valuation multiples this year we can now start to plot the current positioning of the market versus historical averages to gauge whether or not equities are attractive. On the graph above I have the forward 12 month P/E ratio of the S&P500 which currently stands at 17.6x and represents a level of 4,029. Overlapped on the chart I have 5, 10, and 15 year average multiples along with corresponding S&P 500 prices.

The current fwd P/E ratio of 17.6x is below the five-year average of 18.6x which gives a fair value of 4,231.5 using consensus forward EPS estimates of $227.5 for 2022. However, the market is still above the 10 and 15 year average multiples of 16.9x and 15.6x, respectively.These longer term multiples give S&P 500 fair value levels of 3,844 and 3,549 which correspondingly represent -4.59% and -11.91% drawdowns from today’s prices. As we progress through this market volatility we think the ~ 3,900 level on the S&P 500 represents a good place to start buying as this would be in line with the markets 10 year multiple along with a roughly 20% drawdown from the peak which signals the market has priced in a mild recession. We will keep you updated as we advance through this period of changing fed policy and market volatility.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.