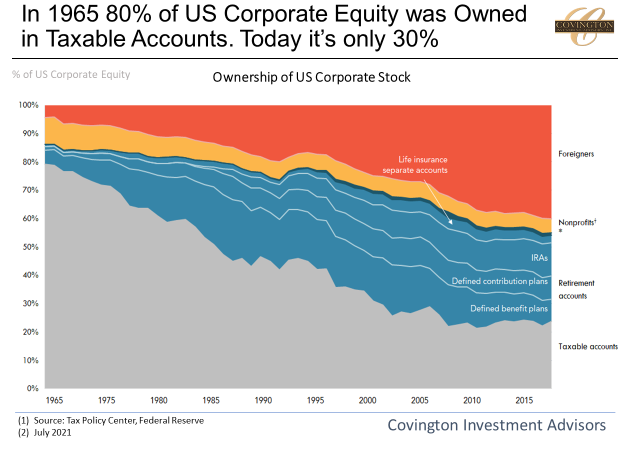

Earlier this year stories started to break that the Biden Administration was planning to raise the capital gains tax rate on wealthy Americans to 39.6% and recently whispers are floating around that the new rate could be even higher. Rumors of rising taxes usually invokes an anxious response by markets especially after a strong run like we have had. But the effect to the overall market from the capital gains hike may not be as significant as people think as it will only affect a minority portion of today’s equity accounts. In 1965 80% of US corporate equity was owned in taxable accounts. Today only roughly 30% is owned in taxable vehicles with much of the US holdings shifting to tax deferred accounts which are not affected by capital gains taxes. Foreign investment has also eaten up a large share of domestic equity holdings as the US runs ever growing trade deficits.

Arguably the corporate tax rate change will have a greater impact to public markets which we wrote about last year and can be read here. However, both of these new tax initiatives will have to be passed through the Washington machinery before we know what the final product will be.

Bottom line: Rising taxes is not a welcomed development to investors, but what will really drive long term equity returns will be the rate of change in economic growth and liquidity. Tax policy will be a secondary issue to the overall market. From a tax planning standpoint, a higher capital gains rate will not change our policy of controlling tax consequences through using low turnover portfolios, annual tax loss harvesting in taxable accounts, and having a financial plan.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.