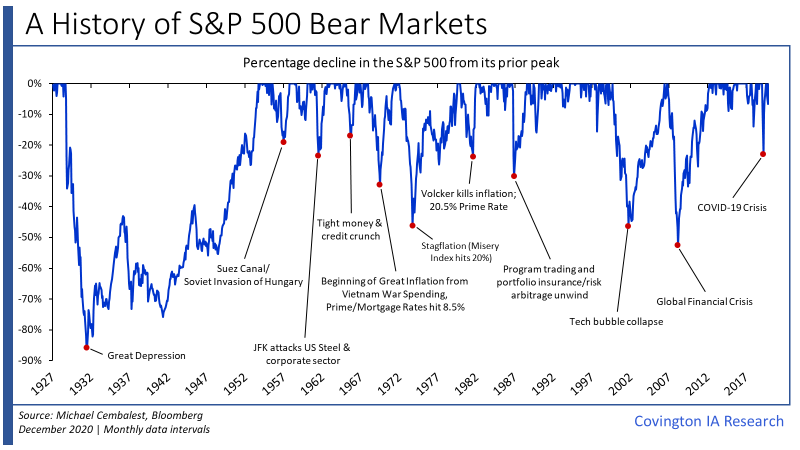

Market drawdowns and Bear Markets are a reality when it comes to investing in the equity markets. Part of the reason equity holders receive a higher long-term return over ‘safer’ investments such as bonds is that they take on additional risk and the likelihood that their investment will be negative over stretches of time. Of course no investor wants to experience their investment losing money but this year illustrates perfectly why sticking to a plan and staying invested while owning proven enterprises with strong balance sheets is the prudent approach. This fact of investing is nothing new but the rise of social media and the competitiveness for media headlines since 2010 have given way to a flood of negative market calls which naturally appeals to human negativity bias and our survivorship instincts. This appeal strategy has worked in part because the flood of calls followed two of the deepest bear markets since the great depression: The Tech Bubble & Global Financial Crisis.

Of course, just as there is inherent risk with being invested in the equity markets, there is also risk in not being invested.This is through the opportunity cost of trying to time the markets by jumping in and out of investments or dramatically drifting away from asset allocations due to “Armageddonist” media headlines. For example, $1 shifted from equities to bonds in 2014 in response to mega-bearish commentary would have underperformed equities by roughly 40% as the S&P 500, propelled more by earnings growth than by multiple expansion, rolled on.

This is not to say that bearish market viewpoints have no merit or that stock market volatility is something to ignore. Conversely, it is to prepare for these periods by having a calm, fundamentalist approach for when market volatility inevitably happens again. Just as human instincts are hardwired to be naturally cautious, they are also programmed to continuously advance and improve which is part of the reason why corporate and economic outlooks improve over time.

Michael Cembalest sums up this dynamic much better than I can in his original 2019 paper which can be found here. And also his updated post-COVID paper here.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.