After 18 months of very little volatility a cascading series of events including the escalation between Russia and Ukraine have reverberated throughout markets causing our first 10% percent drawdown in large cap stocks since March 2020. I'm not going to try to predict the path of military actions in Europe but I can try to put into perspective what the economic impact might be from what's taking place in the region.

Geopolitical events by their nature are difficult to predict and tend to be short lived, although there are certainly exceptions.Outside of the commodities sector, Russia is a marginal player in the world economy accounting for only 1.3% of global GDP, and Ukraine makes up an even smaller portion. US exposure to Russia in terms of total trade is a very low 0.1% of GDP. The EU on the other hand sources roughly 1.5% of their total goods trade with Russia. The main exposure is that commodities are a global market with Russia accounting for about 10% of global oil production and the EU has become ever more dependent on imports for energy. EU imports have long represented over 90% of its oil consumption, while the natural gas import share has increased from roughly 50% in 1990 to also over 90% today. By contrast, the US has moved from importing over 50% of its oil & petroleum during the 2000s to being a net exporter today. So in theory the first order effect from rising energy prices should be modest to the overall US economy. Still, the second order effects of a shock to the already tight global energy market is what could be disruptive.

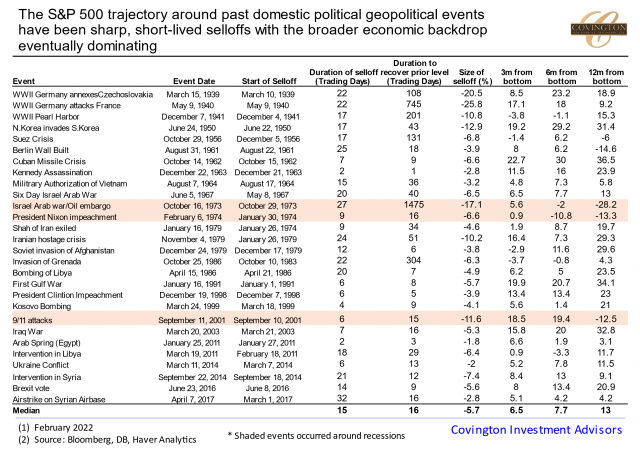

When looking back at similar geopolitical shocks what we have found is they have rarely left a deep scar on markets and it is ultimately the underlying economic context that often ends up driving the response. Past performance does not guarantee future results but similar historical events have had a median sell off of -5.7%. They tend to take around 3 weeks to reach a bottom and a further 3 weeks to recover prior levels. On average the market was +6.5% and +13% higher from the bottom 3 and 12 months after. What’s important from the table above is that when looking 12 months out from the event the markets response depends significantly on the underlying economic circumstances at the time of the shock. Even before events escalated around Ukraine, the market was going through what we called an ‘adjustment period’ in past notes (here), namely digesting the change in inflation and monetary policy. And while we coin this an ‘adjustment period’, the US and global economy have strong momentum going into the crisis forecasting above trend growth for this year. That’s still likely to be the dominant theme in 2022 and beyond, although an even further escalation of events could change the developments in the mix.

Environments like this are why we constantly emphasize the importance of having a financial plan and being disciplined even when market volatility is low. This includes having 12 months of operating cash set aside to bridge any budget needs during turbulent market conditions. Additionally it underscores why our investment philosophy is anchored by owning domestic, large-cap, proven enterprises that have a track record of not only surviving periods of stress, but paying good dividends to shareholders through them and adapting to come out stronger on the other side.

As always, we are available if you would like to schedule a time to meet and discuss these matters further.