Quality Factors of Our Investment Philosophy

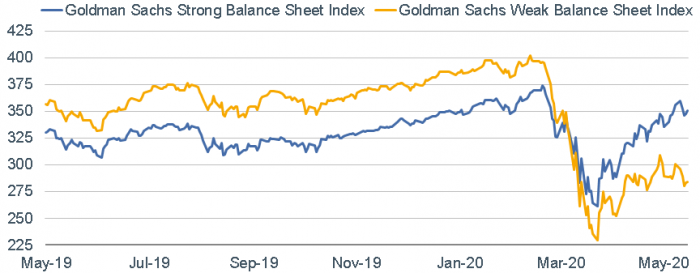

One central part of our investment philosophy that we constantly preach is owning companies that have strong balance sheets. What this means is that they have limited liabilities including debt on their balance sheets as well as low working capital requirements. We also look for those companies that have large amounts of cash on their balance sheets. When these strong balance sheets are paired with good capital allocating management teams future returns tend to be strong in both up and down markets. Goldman Sachs recently created “strong balance sheet” and “week balance sheet” baskets of stocks with the former outperforming the latter.

Strong Balance Sheets Outperform Weak Balance Sheets

Source: Goldman Sachs

Another key piece of our investment philosophy is a bias towards large capitalization stocks. We believe these are the companies that have natural competitive advantages over smaller counterparts while also tending to provide less downside risk. This dynamic has been amplified by the coronavirus pandemic. These large companies have the online infrastructure in place to be able to keep their revenue flowing through e-commerce and being deemed “essential businesses” while many smaller competitors do not. We think this puts large businesses at a huge advantage that will most likely last even when the coronavirus passes.

Ned Davis Research recently published an interesting study comparing S&P 500 (representing large cap companies) to S&P 600 (representing small caps) in terms of COVID-19 “exposure”.

Source: Ned Davis Research

Based on quantitative and qualitative factors NDR found that over 57% of large cap stocks have been “beneficiaries” of the economic environment caused by the virus. Conversely, 58% of the small cap counterparts were found to be “laggards” due to circumstances brought on by the virus.

As market dynamics change, our core investment philosophy remains intact of buying proven enterprises with healthy balance sheets that are not overleveraged.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.