A New Worry

Almost right on queue to our recent note regarding the Wall of Worry we had a new geopolitical event over the weekend as tensions escalated in the Middle East as Iran launched a drone and missile attack on Israel. Markets sold off at the end of last week in anticipation of the move but have stayed relatively tame as the chances of further escalation seem restrained, at least based on the rhetoric in response to the attacks so far. Let’s hope this is the case but this is a notoriously volatile relationship.

In February 2022 when Russia invaded Ukraine causing some anxiety in markets we put out a note showing that historically geopolitical events tend to lead to short-sharp selloffs lasting around three weeks before the overall economic backdrop ended up driving market performance (that note is here). That turned out to be true for the Ukraine event as the market actually closed green that day but recession fears sent markets lower for the rest of the year before bouncing back in 2023 when the recession did not materialize. Once again I will not try to predict the path of geopolitical events but it seems that will be the case again.

Today the economic backdrop is the economy remains in the later stage of an expansion but to this point has stood up remarkably well to higher rates and economic growth is forecasted to remain positive. The last two inflation readings have shown that prices are getting sticky around the 3% year-over-year mark which may keep the Fed on hold for longer than is currently priced in, but as long as a 1970s style rebound to cycle-high inflation does not occur then the Feds path should not be too affected.

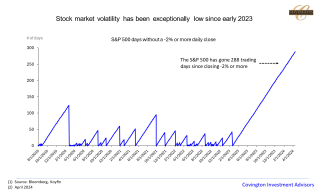

Additionally, the market is probably poised for a bit of a pullback as equity valuations are elevated and have been on an incredible streak of pretty low volatility. Today's chart shows that the S&P 500’s current streak of 288 days without at least a 2% pull back is by far the largest going back roughly 5 years. A pullback from here would be normal and sticky inflation or worries about tensions in the Middle East would be a good excuse. Similar to Russia/Ukraine the risk is that a tipping point significantly drives up the price of oil which flows through to the rest of inflation - but until we get to that point it’s hard to ignore the template of the last several decades.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.