2023 Holiday Economic FAQs

It's that time of the year again. Time to get together with family and reflect, but also to think about what's in store for the year ahead. Topics at your family gathering may be wide ranging but none are as exciting as the economy and markets. So in case these topics come up, we are here to help with 5 questions that we think are most likely to arise or you have yourself. For each question we suggest both a short and long answer - depending on if the topic comes up over dinner or dessert, and how lively the discussion is.

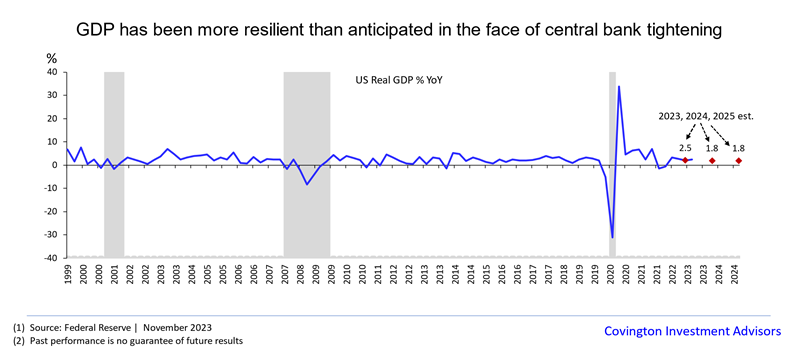

- Last year everyone was talking about a recession. Now economic growth is showing 5% percent. What happened?

Short answer:The economy has proven to be more resilient to higher interest rates than expected.

Long Answer:Going into 2022 the fear began to rise that with central banks beginning to pivot from ultra accommodative monetary policy (low rates, quantitative easing) to very restrictive policy (raising rates, quantitative tightening) that economies would plunge into recession. On top of this you had many of the traditional recession indicators starting to flash warning signs of an impending contraction. The economy has held up remarkably well despite more than 500bp of Fed rate hikes. GDP has increased by 3% over the last four quarters, the unemployment rate is very low (3.7%), and over 4.5 million jobs have been added on net since just before the pandemic started. One of the reasons is that a lot of households and businesses locked in low fixed borrowing rates before the Fed started hiking. So they were less affected by higher interest rates.

The economy should slow down in 2024, with GDP growth averaging less than 2% but still remaining positive. But a recession now appears far less likely because consumer spending should remain solid, the housing market is showing signs of bottoming, and the labor market has not yet shown signs of cracking. Even if there is a recession next year, it is likely to be mild. There has been so much talk of an impending recession for so long that those imbalances, which often result from excessive leverage or risk taking, have not built up. We thought we were talking ourselves into a recession, but we might have ended up talking ourselves out of one instead.

2. So does that mean a recession has been avoided and we are in the clear?

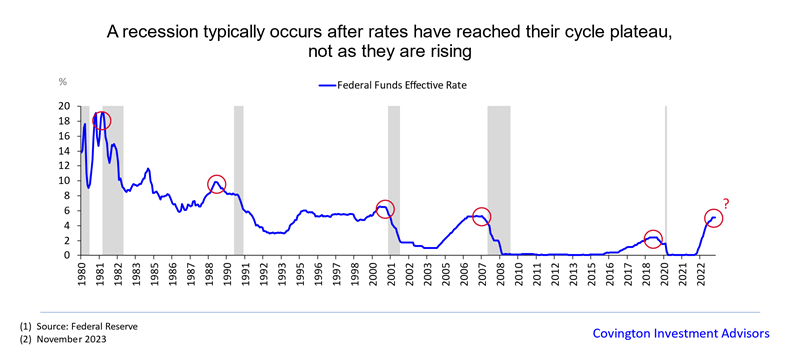

Short answer: Not yet. A recession could still happen as the lagging effects of Fed tightening moves through the system.

Long answer: It’s not an exact science but it is estimated that the effects of rate hikes can take anywhere from 12-18 months to fully cascade through the economy as debt is refinanced and consumers adjust.

It's also important to note that the economy and markets tend to remain strong in the initial hiking phase of rate cycles and only weaken after policy has remained restrictive for a period of time. That being said, at this point the chance of avoiding a recession and instead achieving a “soft landing” is much higher than it was this time last year. Housing and autos in particular have held up better than expected amid higher rates and there are signs that these sectors could be bottoming for 2024. On the other hand, shrinking consumer surplus and the economy adjusting to the lagging effects of higher rates means we are not yet in the clear. In fact, its counterintuitive but the only time you know that a recession is not ahead is when you are currently in one and the economy as a whole is troughing. As of now it is starting to look like we are in a mid to late cycle slowdown as opposed to a recession.

3. So is the Fed done raising interest rates? Will rates now be cut?

Short answer: Yes, the Fed is most likely done raising interest rates and the next action will be cutting interest rates.

Long answer:Inflation has largely been tamed although price levels are still higher than pre-pandemic levels. Estimates are now for the Fed to lower rates in lock step with falling inflation in 2024 in order to prevent a recession. This is still a bit of a tightrope act as the Fed wants to lower rates so as to avoid spurring a recession by imposing restrictive debt costs on households - but they also do not want to lower rate so much that it allows the economy to overheat again resulting in inflation picking back up as it did in the late 70s. Right now markets are pricing in 3-4 rate cuts starting in March but we would not be surprised if rates are on hold until the second half of next year.

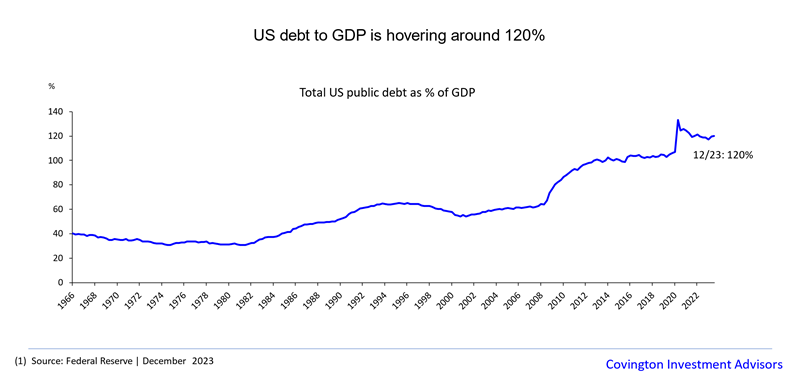

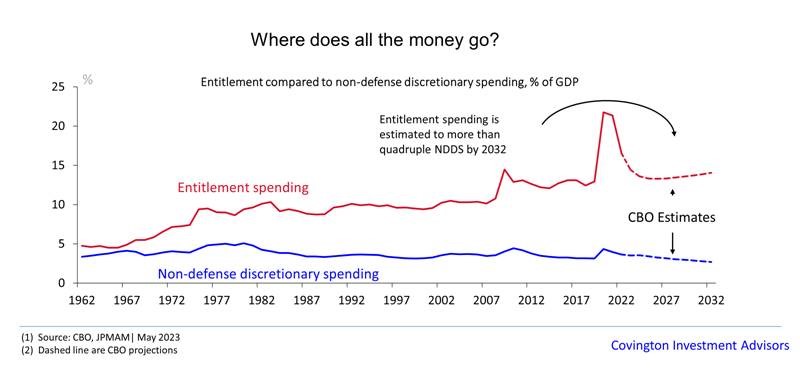

4. I'm worried about the national debt. When is it going to stop climbing and will it cause an economic collapse?

Short answer:The national debt is probably not going to stop climbing anytime soon and most likely it will not trigger a collapse but instead drag down economic growth.

Long Answer:In 2023 the national deficit roughly doubled due to some quirks around changes to student loan forgiveness and increased government spending. The national debt amount will never be fully repaid and it's really not meant to be. The deficits are what is unsustainable and eventually something is going to have to give here. But what’s challenging is that most of the fiscal burden is in entitlement programs that nobody really knows how to control. At some point, the debt-to-GDP ratio becomes too high and has important economic implications. It can lead to higher interest rates, crowding out private investment and lowering the productive capacity of the economy. Additionally, it can lead to fiscal dominance, where the Fed loses its ability to control inflation. The US can run higher debt-to-GDP ratios than most other countries without triggering these adverse scenarios for a variety of reasons, including the dollar’s role as the world’s reserve currency. The fact that there is almost always demand for dollar-denominated assets helps keep a lid on US interest rates.

The consequences of these poor budgetary choices are usually framed as a future cataclysmic economic collapse but I think the end result will be something less dramatic. As the national debt keeps rising it will cause slower and slower economic growth and more frequent contractions - essentially what has happened in Japan since the 1990s.

5. So markets are doing great. Should we have another 20% next year?

Short answer:Market returns from here will likely be modest as stock valuations are elevated and economic growth will moderate due to higher interest rates. But a recession looks less likely than it did last year.

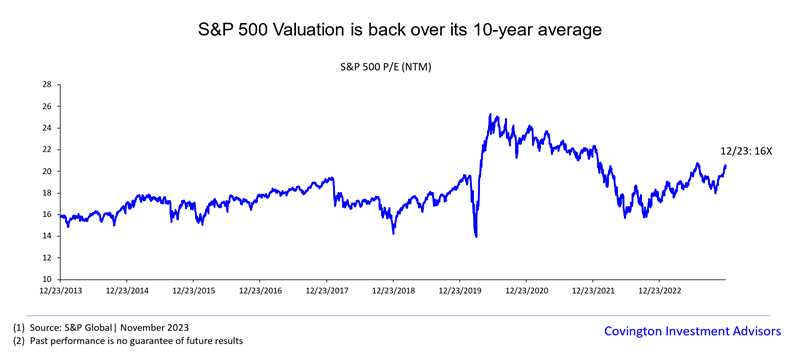

Long answer:Stock returns have been very strong in 2023 but it is important to remember the context that we are coming out of a dismal -20% year in 2022. Therefore much of the returns in 2023 can likely be attributed to markets correcting a prior mistake made in 2022 as opposed to forecasting exceptional future growth. This can be seen as corporate earnings will likely come in for the year with flat year-over-year growth signaling much of the stock market returns have come from multiple expansion. As such, valuations are back to a level where you would say the market is fully valued or perhaps even slightly overvalued. Still, what markets care about is recession or no recession. Estimates are for corporate earnings point to 11% growth in 2024 - which we think is too high and will be revised down… But nevertheless, if we avoid a recession, get positive earnings growth, and falling inflation allows the fed to posture as dovish, then that would point to an attractive market environment.

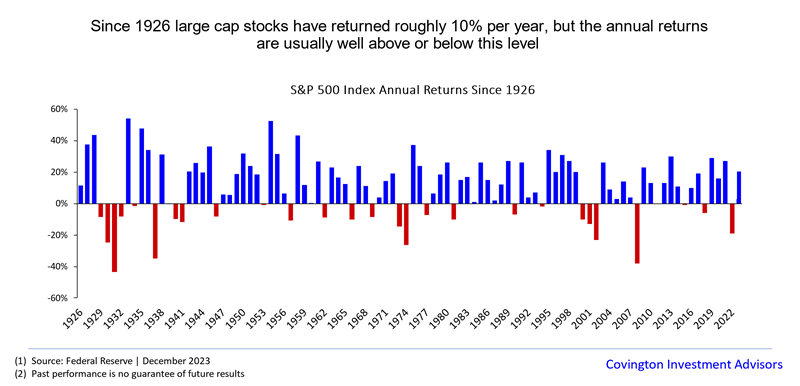

But as we always emphasize, predicting the year-to-year returns of the market is a fool's errand. Where you get your returns from is holding high quality investments and allowing them to compound for long periods of time. We always prepare as if a recession will happen tomorrow and we are ready to weather it by owning proven enterprises that produce cash flow.

I hope these help not only answer your questions but also livens up those family holiday conversations. We hope you all have a Merry Christmas and look forward to seeing you in 2024.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.