Taking Inventory of the Economy

So far 2024 has been another strong year for markets. As we head into the end of the year and election noise is on everyone’s mind I think it can be helpful to recalibrate and look at what the actual fundamentals of the economy and markets are showing.

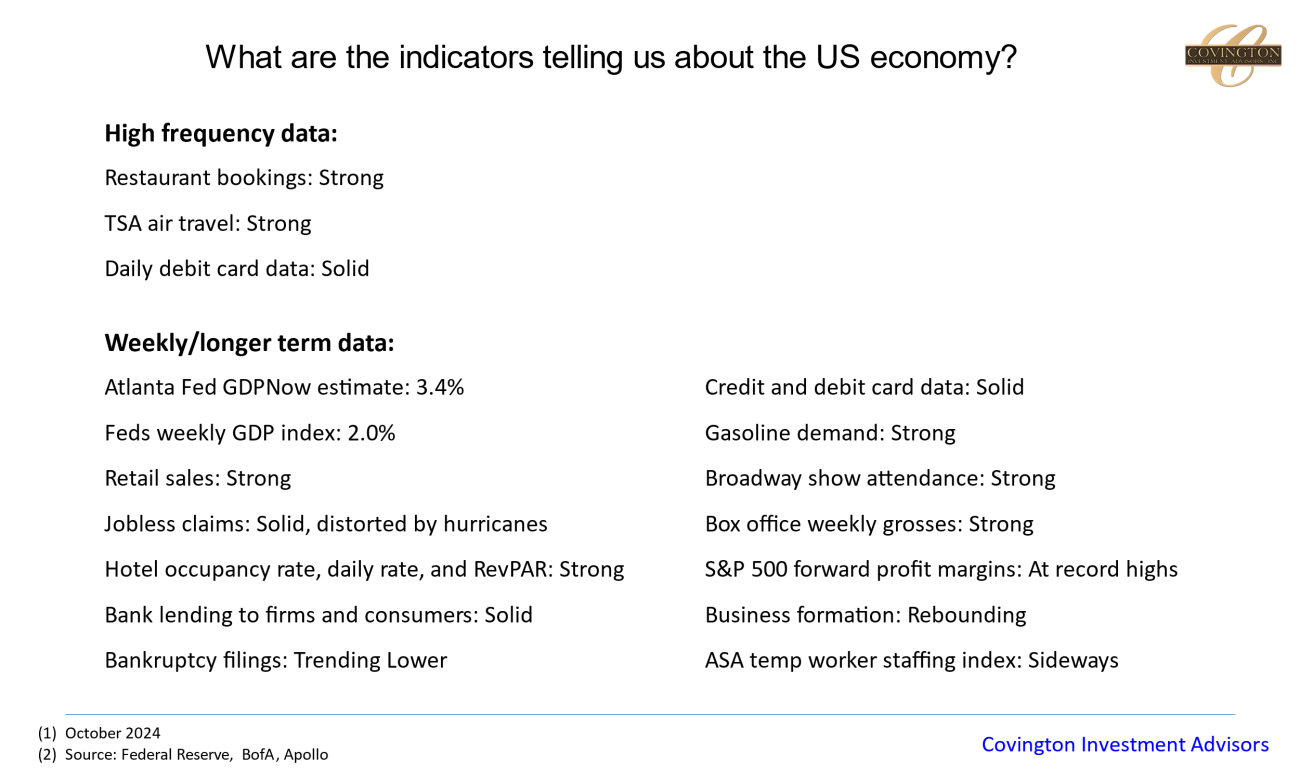

From a high level the economy remains strong. Economic growth continues to be positive for both the US and global economy even despite the recession scare that took place in 2022. US real GDP growth, which is essentially a summation of economic output, is estimated to come in at 2.4% for 2024. Inflation, while still positive, has finally approached the Federal Reserve's target rate of 2%. This has allowed the central bank to begin lowering rates while the economy is expanding opposed to easing policy in response to an economic shock. The labor market has also remained strong but will be the most closely watched metric of the economy going forward. The unemployment rate is still low at 4.1% but has ticked up from its trough of 3.4% in April 2023. Job growth has also slowed significantly in the last twelve months including large downward revisions in the headline data. This rise in unemployment has triggered the “Sahm rule” recession indicator which we wrote about in a recent note including how it is calculated and why unique contemporary policies may affect the reliability of the indicator. Nevertheless, taking into account the broader macro data none of it points to a crumbling economy.

The US also continues to benefit from advantages over global peers. Energy has been one of these significant advantages. While Europe has had to deal with volatile energy policy following the war in Ukraine, the US has been relatively insulated from energy shocks. New drilling technology such as fracking has allowed domestic oil companies to bring on new production capacity much more efficiently than could be done in the past. The unstable energy situation in Europe has arguably benefited the US as since 2020 the US has been a net exporter of petroleum. And with Europe decoupling from Russia that puts the US in an advantageous position to export a valuable commodity.

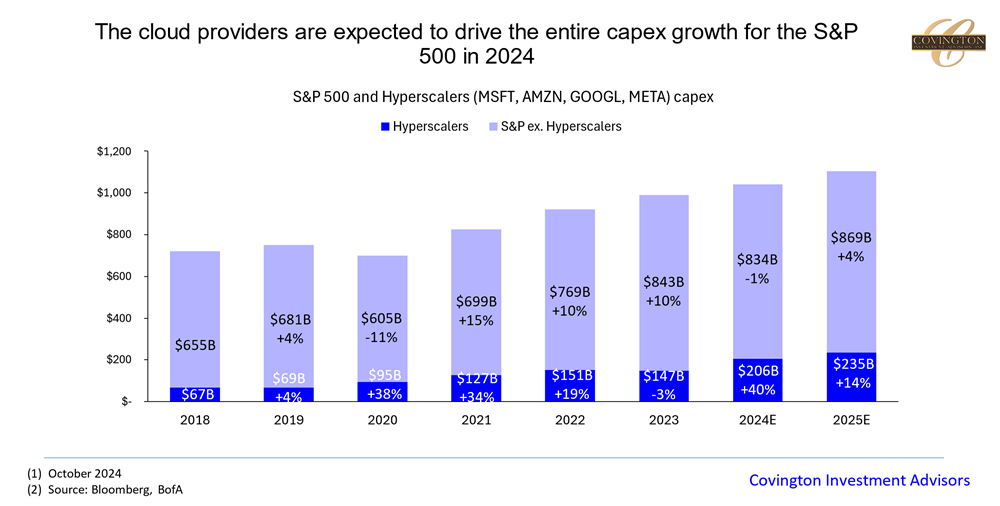

Accommodative fiscal policy has been another big boost. Large fiscal packages coming out of covid combined with the US’s strong energy position has spurred a capital investment cycle in the US which has boosted its relative performance. Adding to this, the optimism over Artificial Intelligence (AI) provides an exciting growth lever for the technology sector. Like the US’s position in energy products, domestic AI technology including semiconductor chips, machines, and software is by far the leader. And again, like energy, a lot of these technologies are high margin and exportable, making them very valuable for the economy as a whole. The large cloud vendors (Amazon, Microsoft, Alphabet, Meta), also are contributing to the capital investment boom as they are expected to contribute almost all the capital expenditure growth in the S&P 500 for 2024. This capital investment cycle has led to an increase in productivity which was anemic coming out of the recession in 2008.

Looking forward, growth forecasts remain strong. For 2025 the IMF projects the US to grow 1.9% versus 1.7% for all advanced economies and 3.1% for the global economy. China, which for decades had been the growth engine in the emerging markets, has been undergoing weakness in recent years as a broad economic slowdown and struggling real estate sector weigh on growth. The Chinese economy is expected to grow 4.5% this year and 4.7% in 2025. This is still positive expansion, but much lower than the growth they were experiencing prior to 2020. China's economy is unique in many ways and the data must be taken with a pinch of salt. Still, large stimulus measures have recently been announced by the Chinese government and a reacceleration of their growth would be a cyclical tailwind for the world economy.

So, all of that paints a pretty rosy picture, but like always there are pieces of data that do flash some warnings. As previously mentioned, the labor market is the biggest focus of recession concerns. As the economy transitions from a period of tightening monetary policy and falling growth, it is very difficult for there not to be any significant uptick in the unemployment rate. If the labor market were to undergo a significant deterioration that would be a forward indicator that the economy would be poised for a contraction.

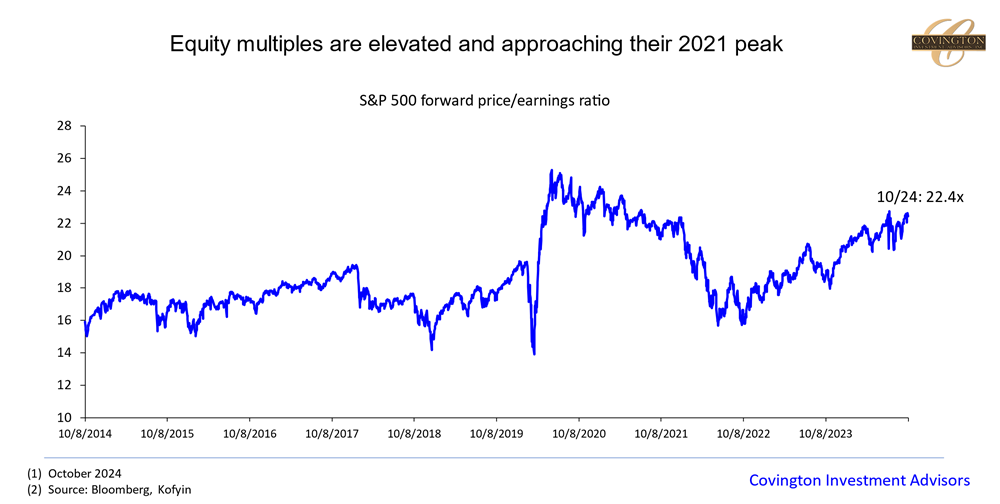

Looking through to markets, the strong economic picture outlined is largely already priced into stocks with the S&P 500 trading at 22x forward earnings which is near the high end of its valuation range. High valuation is not unusual when markets are at all-time highs, but it does signal that the market could be ripe for a routine pullback. However, when zooming out and taking inventory of the broader economic data, the picture is much the same as it has been for the last two years: An economy that is slowing but still expanding, and being boosted by advantages in energy and technology.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.