Return to Normalcy

It's only March but this year has been exceptionally eventful in the economic world... Or has it? Actually so far 2025 has been more of a return to normalcy as it relates to equity market behavior. The prior two years were outliers as not only were returns strong with the market posting back-to-back 20%+ years, but additionally there was very little volatility. An anomaly we wrote about here.

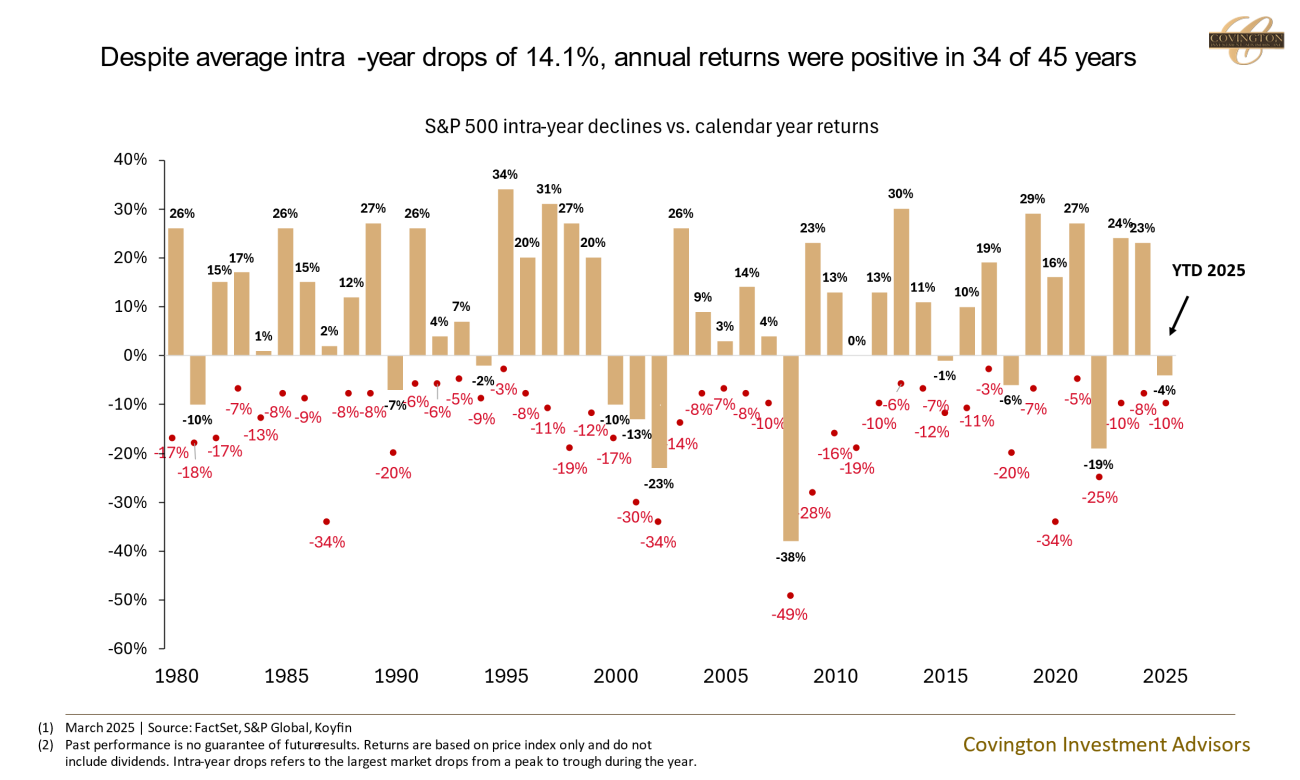

Flip the page and this year we’ve already had a 10% drawdown in large cap equities sparked by a combination of trade wars, political developments, and a recalibration of corporate expectations. But looking back through history, volatility and drawdowns in equity markets is normal. Going back 45 years, the average intra-year selloff in the S&P 500 has been 14.1%. Despite this the S&P 500 finished 34 of these 45 years positive with an average total return of 10.1%. Even 2023 and 2024, both years where the S&P 500 finished with calendar year returns of over 20%, had -8% and -10% drawdowns during the year.

So am I saying just brush it off and expect markets to have another 20% year? Not exactly. But what I am saying is that selloffs, noise, and volatility are expected in stocks. Stocks, like any other asset, are ultimately transacted by humans which makes them subject to sentiment and changing expectations. It also cannot be said that we got our episode of volatility out of the way for the year and it will be smooth-sailing. Since WWII there have been 48 total 10% corrections on the S&P 500, 12 of them turned into a 20% bear market - so about 25% of the time. Almost all of these episodes coincided with a recession. The slowdown in economic data right now looks like a cyclical growth slowdown as opposed to a recession. But even recessions, as painful as they are, are a normal element of investing. The excess returns that are earned on the upside help cushion drawdowns and years where markets are weak. We have always emphasized broader financial planning elements, such as emergency funds and portfolios with dependable cash flow along with defensive portfolio construction that allow for growth and value to protect our downside during these crucial times.

I also don't think that the selloff in equities to start this year is fundamentally irrational. Markets started showing signs of exuberance over the last six months particularly post-election as the most speculative assets rallied to all-time highs with not much change to the underlying earnings expectations. By almost any metric the S&P 500 came into the year more expensive than its historical average. However, elevated stock valuations do not signal a crash is imminent. Contrarily, it typically signals a strong underlying economy - which I still think is the case even as cyclical weaknesses emerge. But high valuations do signal that a market pullback would be routine in order to get stock prices more in line with realistic fundamentals of corporate earnings. This is especially true in the technology space where a recalibration in artificial intelligence capital expenditures is a looming metric that markets are watching closely. I think trade war tensions are being a bit overblown at the moment as they make splashy headlines, but no doubt they will have some impact on corporate earnings. We wrote a recent piece here outlining what tariffs are, what the administration is trying to accomplish with them, and what the possible market implications are. The extent and impact of government efficiency measures are also trying to be handicapped by markets as deficits will have to be reined in.

So bottom line: the volatility that markets have undergone in the first quarter is not unusual and we need to be prepared for more as the year goes on. As always there are risks to be cognizant of. Owning high quality investments with strong balance sheets that can weather the storm is the best approach to compounding capital over the long term. Market drawdowns are a normal part of the cycle and are crucial as opportunities to deploy capital at attractive multiples. The takeaway from today's chart should be that while long-term returns from stocks have been attractive, drawdowns and negative years are some of the risks that have to be accepted to earn this return.