Liberation Day and Navigating Volatility

The last week has seen a historic transformation of the global trading system, as President Trump's “Liberation Day” announcement of massive tariff hikes against nearly every US trading partner has shocked market participants. A plan for reciprocal tariffs was well telegraphed but the market was caught off guard by the magnitude and timing of the policy. Consensus expectations were for a 10% headline increase in the import-rated tariff level across the board. What was instead announced would amount to a roughly 18% increase (13% including product exclusions). Several countries which are critical production hubs for US goods, such as China and Vietnam, have tariff rates imposed that are at an even higher rate. China, in particular, was always expected to be the main target of tariffs, but the escalating rate on imports of Chinese goods has far eclipsed the pre-Liberation Day estimates. As of writing this, the effective tariff rate on Chinese goods is 104%.

All of that combines to create a much more significant shock to the economy and thus raises the number of downside risks including a recession, or worse, stagflation - stagnant growth and higher prices. Whether the tariffs are enough to tip the US into a recession will depend on the duration and final level of restrictions. Nevertheless, it’s hard to envision a scenario where abruptly shutting off globalized supply chains does not result in a growth contraction.

Impacts to GDP are hard to forecast due to the myriads of potential variables including reciprocations, duration, and final rates of the tariffs. Right now, the consensus expectation is a roughly 2% negative impact to GDP growth, which will take 2025 forecasts from 2.5% to 0.5% putting the US on the precipice of a contraction. Typically, for every 1% impact to GDP, S&P 500 earnings per share are impacted by $7-$10, meaning there could potentially be a $20 headwind to S&P 500 earnings per share for 2025. This impact will not be uniform across the economy. Sectors like consumer retail and electronic hardware that are highly dependent on Asian supply chains have taken the largest hit so far. Some businesses, especially those with leveraged balance sheets, could be permanently impaired. However, companies with strong management teams, resilient customers, and strong balance sheets will operate through this shock and take market share from their less resilient competitors.

Going forward from here there will have to be some positive news on trade deals, or a policy reset in order to change the sentiment of fear that is driving markets. In the medium term we will begin to see how earnings hold up to the supply shocks. A positive here is that supply chains underwent a significant overhaul during covid, and many companies took that opportunity to diversify themselves away from China - ostensibly the main target of tariffs. Past that the traditional recession indicators of the labor market and credit spreads will be watched closely.

The policy situation could also play out in a number of different ways. The first scenario is countries could scramble to negotiate long term deals that mutually balance the benefits of trade. Bond yields would stabilize, and equity markets would quickly recover some of their losses led by the sectors which have been hardest hit thus far. Even in this positive scenario economic and corporate earnings growth will take some time to recover. The other scenario is the global standoff continues without deals being reached and pure trade restrictionism is the new paradigm. In this scenario growth will take longer to recover as domestic production capacity takes time to absorb the shock.

The most likely path is somewhere down the middle where deals are made on a country-by-country basis, but restrictions are not lowered enough for supply chains to go back to status quo. With events being so fluid we need to be prepared for further volatility - both positive and negative. The Trump industrial policy framework has also been outlined as a ‘three-legged stool’ consisting of tariffs, deregulation, and lower taxes/government spending. Shocking the system by enacting punitive tariffs will get the attention of trading partners, but without the other ‘two legs’ of deregulation and lowered taxes it will drag even further on growth.

Volatility in equity markets is a given, but how investors react to these fluctuations will impact whether they are successful or not in reaching their long-term goals. When markets undergo widespread sentiment shifts from optimism to fear, it is not the time to panic or drastically change investment strategies. At times when markets are at all-time highs, we make it a point not to deviate from investment principles out of greed by reaching for speculative returns - correspondingly when markets are going through a downturn, we are not going to deviate from those same principles out of fear. At a time when new information is being produced constantly, keeping this disciplined approach is crucial.

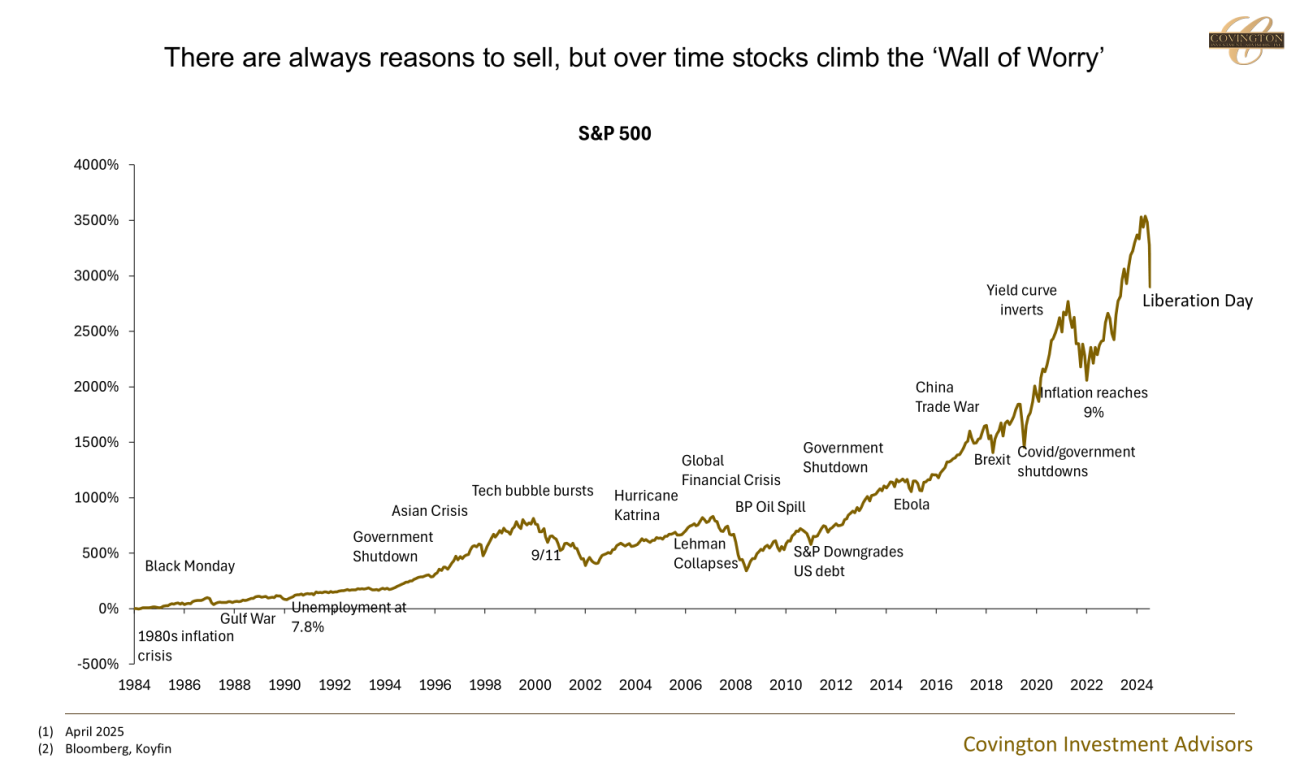

In the past, we have written at length about the perils of market timing. Staying invested and using volatility as an opportunity to reinvest cash flows is prudent - but trying to jump in and out of the market is futile and will only damage future returns. The market moves incredibly fast - on both the up and downside. The largest positive days occur in conjunction with the worst days at the peak of downturns. In the 1980s, the best time to buy stocks was while inflation was at record highs and the economy was in a cyclical downturn. During the global financial crisis, stocks rose before payrolls and GDP even reached their trough. During Covid, the market low occurred at the peak of lockdowns when many businesses, including some Fortune 500 companies, had their revenue streams go to zero. Some of you will remember there was even a day in 2020 where the price of oil futures turned negative as economic activity grinded to a halt. Buying stocks at that point took a great deal of courage, but it produced exceptional forward returns for investors that accumulated assets when they were the most mispriced.

History doesn't repeat, but it does rhyme. There will always be episodes of panics in markets, especially ones as liquid and large as public stocks and bonds. There's also no reason why this pattern of stocks behaving in anticipation of economic developments that haven't even taken place yet will not repeat. This doesn’t mean there won’t be further volatility ahead or that markets can't continue grinding lower. In fact, I would be shocked if volatility doesn’t stay elevated for the rest of the year as policy develops and the disruption from de-globalization materializes in economic data. But equities and bonds, by their nature, will price in the recovery before we see it in the data - and if history is a guide, it will happen quickly.

The chart in this email plots the performance of US large-cap stocks overlaid with past episodes of panic and reasons to get out of markets. Events listed include wars, bank failures, inflation, pandemics, and recessions. Yet over the long-term markets grinded higher and sticking to sound investment principles produced the best results. The best way to lose money in public equities is to buy only when the economic future is clear and an optimistic picture is priced into stocks, then proceed to sell when headlines induce fear and dropping stock prices.

While it is impossible to say for sure, we are likely near the level of peak policy uncertainty. Swift negotiations could reset tariff policies and support a market recovery, or a continuous escalation in tensions could ignite even further stresses in the broader economy. At a time where information transmits quickly and new headlines are populated every hour it's imperative to stick to the financial plans we have built for you.

This plan includes building a realistic and sustainable budget. Keeping 6-12 months' worth of operating cash in liquid savings as an emergency fund. Assets that are long term monies then are used to build a diversified portfolio of high-quality investments that are stable and produce cash flow. Then, it's important to give these investments a long time horizon to compound through long cycles. Over this time there will be episodes of exuberance and panic. Using episodes of panic as opportunities to allocate cash at attractive prices will enhance forward returns.

Although we have outlined a prediction for the path of events from here, we cannot foresee all that could arise or how markets will react in the short term to new developments. Still, we are sticking to our long-term investment philosophy. As always we are happy to discuss.