Our Strategy is Built for the Long Term

A recent Wall Street Journal article declared “Your Investment Strategy is Broken”. This declaration was made as stock and bond prices have moved in tandem negatively in 2022 and during parts of this year. Traditionally prices of stocks and bonds tend to move in opposite directions, balancing out volatility through various economic conditions. That has not been the case over the last two years as the Fed aggressively hikes rates to fight inflation. Apparently the author of this article believes those are the only two asset classes and that centuries-long human nature has permanently changed in the last three years. I feel this is a sensationalist and dangerous message to be dispersing and would like to restate why our investment approach is not one that is, or can ever be, “broken”.

Our investment strategy approach starts out by incorporating an emergency cash fund. What allows our strategy to work is patience, diversification, and discipline. Having an emergency cash fund so as not to be forced to liquidate long-term holdings at the wrong time is foundational to this. Once we have an adequate cash position built up we begin tailoring a customized plan and building a budget so we can begin appropriately investing long-term funds. Today we are getting back to an environment where we can earn a reasonable yield on cash. That is a welcomed development especially when compared to the recent past where we were lucky to get a couple basis points of yield on idle cash. This provides us a good short-term solution and allows patience while thoughtfully deploying capital into each of your long-term investment programs. Having adequate cash reserves is paramount, but as we will outline later in this note, excess comfort comes at a high price in the investment world.

The next step up from cash on the risk ladder is fixed income investments (bonds). Bonds are nothing more than loans - they can be to governments, corporations, municipalities, or whomever. Most bonds provide a fixed payment just the same as a car loan or mortgage thus providing stability and ballast in portfolios to smooth out returns when volatility arises. But bonds are not without risks themselves. As we have discussed many times over the last two years, rising inflation and a sharp change from all-time low interest rates to cycle high levels has decimated bond prices. This was especially true in government bonds coming out of covid which are coined as “risk free” investments but in reality provided return-free risk! In certain portfolios where it is warranted we do own fixed income. However, for the last few years we have been consistently underweight and have taken numerous steps to shorten duration to make sure our principal is protected. You can read the most recent of these pieces where we outline this strategy in greater detail here .

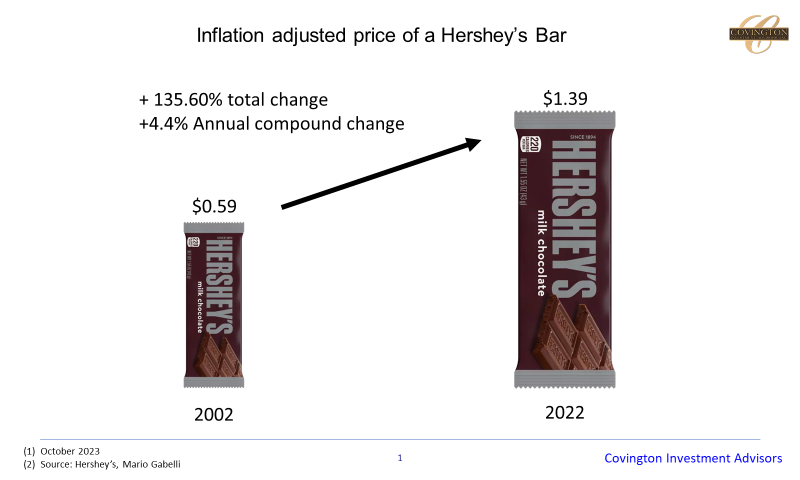

Our preference- and you knew this was coming - is the next category up on the risk ladder: Investment in productive assets through ownership positions in high-quality businesses. Ideally these businesses should have the ability in inflationary times to deliver output that will retain its purchasing power while requiring a minimum amount of reinvestment into the business (see the Hershey’s example above). Also preferable is that these companies will have a limited amount of debt so as not to jeopardize the viability of the business through inevitable economic downturns. These holdings may have a higher risk level in the short term as marketable securities are naturally subjected to the emotions of the people transacting them - But in the long term not owning these assets that have the ability to organically reinvest and compound their earnings to outstrip inflation and taxation is what is risky. Using rough numbers since 1965 an investor would have had to earn 5.5% annually to outstrip inflation and taxation. It's not a coincidence that this has been approximately the return on rolling most moderate duration fixed income investments over this time frame. Sitting in cash you have lost most of your asset base’s purchasing power even if in currency-denominated terms it has stayed the same. In order to grow your wealth and outstrip these confiscatory expenses it has been necessary to own equity investments.

There will of course be highs and lows in the business cycle but I can say with confidence that whether the currency a century from now is seashells, gold, or paper (as today), people will exchange a portion of their daily labor for a treat from Hershey’s or a can of Coca Cola. In the future people will still make life saving health care a priority, and goods will still need to be transported across the country in an efficient manner. People will forever exchange what they produce for what others produce.

I would be remiss if I did not mention gold or crypto in this note. They are certainly different but in many ways the same. The corollary between both as investments is that they are unproductive assets. They are purchased in the buyers hope that someone else - who also knows the asset will be forever unproductive - will be able to sell them to another buyer at a higher price in the future. Tulips, gold, cryptocurrency, NFTs - they are all the same in this regard. Now gold I think is the most durable of these and does have some industrial and decorative utility - but the demand for these purposes is limited and does not compound itself. If you own one ounce of gold for an eternity, you will still own one ounce of gold at the end. No cash flow is produced, no fundamentals provide a floor to prices, and no internal compounding will take place. On the other hand a portfolio of high-quality stocks will produce dependable cash flow through both up and down markets and is comprised of dynamic and bright individuals and products.

So I felt it necessary to reassure you that our investment strategy is not broken. In fact our investment strategy will never be “broken” as it is the only one that has stood up to the test of time. But it does require patience, discipline, and diversification and that is no different today.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.