The Wall of Worry

So far in 2024 markets have continued their strong run from last year as inflation has trended down, GDP has surprised to the upside, and the advent of artificial intelligence has given optimism for future productivity gains. This has culminated in one of the strongest market rallies of the cycle, led almost entirely by large-cap technology and growth.

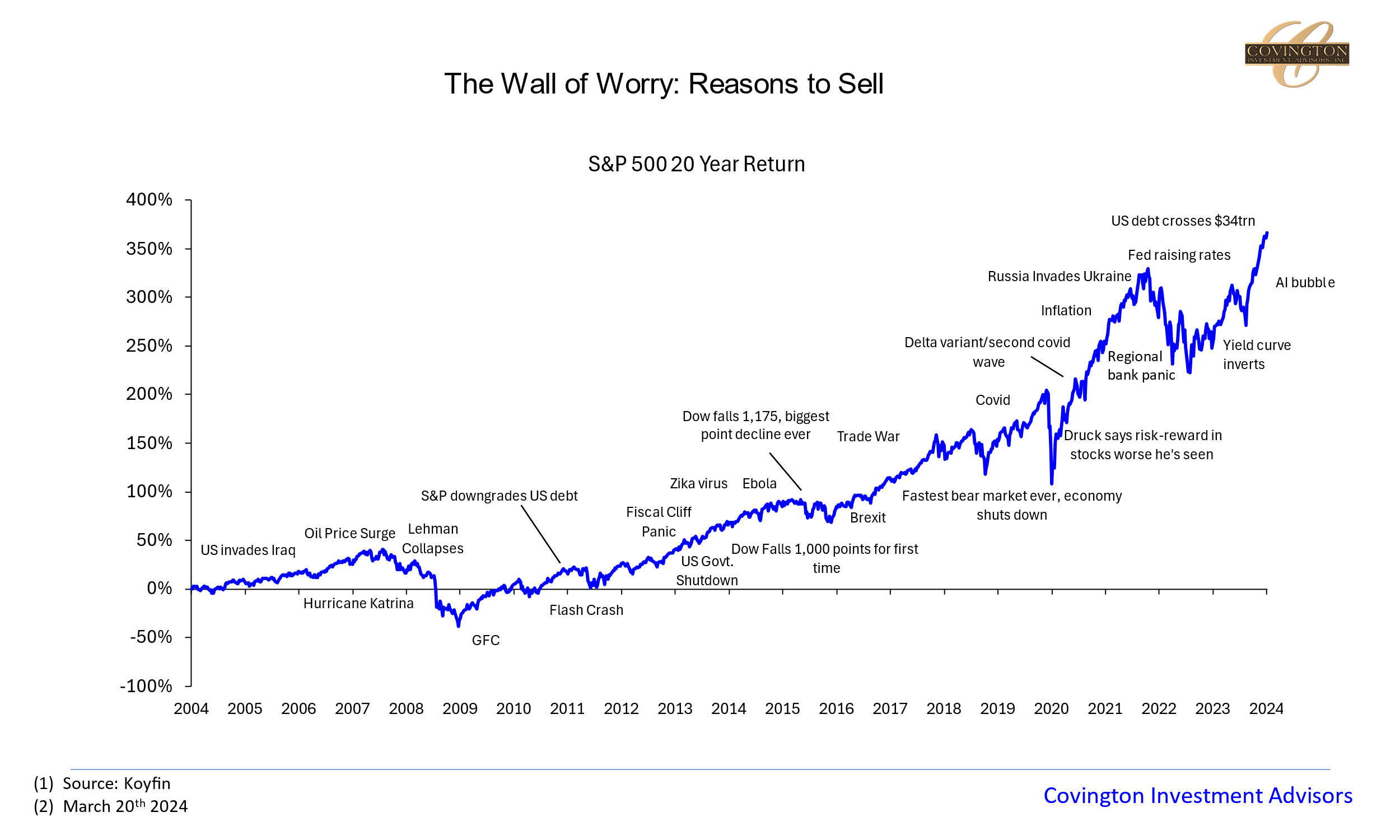

Today's chart is probably our most commonly used one, showing the 20 year performance of the S&P 500 overlaid with the ‘Wall of Worry’- reasons for investors to sell stocks and get out of the market. But as can be seen, US stocks have had incredible resilience at powering through these apprehensions. So much so that looking back some of them seem incredibly insignificant in the rearview mirror or are even hard to remember.

The stock market has a knack for delivering attractive long-term results in a manner that does not always feel so satisfactory in the short term. This has certainly been the case in recent years as the market has undergone large swings in both directions as we commented on in our last note here. Adding to this it has felt like there have been an exceptional number of reasons for stocks to spudder: Inflation, Ukraine War, record sovereign and consumer debt, inverted yield curves, bank panics, central bank tightening, etc. - Yet domestic markets have grinded back to all-time highs.

To be clear, sentiment in markets is currently very bullish and a lot of good news is already priced into stocks. There is the old adage in investing “Be fearful when others are greedy”, and looking around at some of the current developments in markets you can certainly see some greed meaning we are likely to get a pullback in the near term. Still, when looking at the current underlying fundamentals of the economy and markets, things are okay - Inflation is sticky but well off its peak, labor market is strong, supply chains are continuing to normalize, and corporate earnings growth is projected to be low double digits. Of course the economic landscape can change quickly and there are surely reasons for investors to have pause at the current market juncture. But for now stocks continue to climb the Wall of Worry.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.