Now What?

Almost like the dog catching the car it appears we have finally reached the end of the Federal Reserve's tightening cycle as inflation has rolled over and the labor market has remained exceedingly strong. We think inflation remains sticky around 2.5%-3% and a resurgence cannot be ruled out which might keep the Fed on pause for longer than the market is expecting, but nevertheless the next significant move in rates will likely be lower. Markets have celebrated this with stocks staging a sharp rally to cap off 2023 and have carried that momentum into the beginning of this year. What's more is that the consensus view of an impending recession has yet to materialize.

In mid-2021 when inflation first took off and the Fed began signaling it would start raising rates markets went through a stretch of anxiety. Around that time we wrote a piece outlining how historically markets remained strong in the initial phase of hiking cycles with the caveat of increased volatility (that piece can be found here). However, even in the context of historical precedents the ensuing annual market swings exceeding 20% both up & down were exceptionally volatile. Such moves are usually associated with a recession.

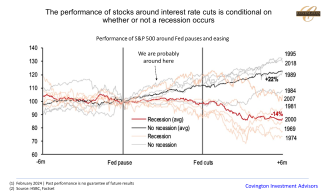

Much has happened since, but the looming issue in markets over this whole time has been the dynamic of how the economy, and thus stocks, would adapt to the transition from ultra accommodative monetary policy (Zero % rates) to the sharpest tightening cycle on record (5.5% rates). Up until this point the economy for the most part has adapted and stocks have shrugged it off. Going forward from here the looming issue will be the juxtaposition of what started in 2021: When does the Fed begin cutting rates and how will the economy and stocks adapt to that transition? Like we did in 2021 we have compiled historical precedents of past easing cycles to get an idea of how stocks reacted in the coming years.

The disappointing answer is that the roadmap from here is not as clear as it was in 2021. Using the historical time frame of 6 months before the Fed pauses, followed by 6 months after the first rate cut, the results are bifurcated. In easing cycles where the economy avoided a recession stocks on average are up 22%. Alternatively, scenarios where the economy was tightened into a recession resulted in stocks being down on average 14%. As of right now the consensus view is that the economy will avoid a recession and achieve a soft landing, boding well for the former scenario. However this can change quickly and the reality is that since we have already passed the trough and peak of economic growth rates the rest of this cycle will be characterized by recession scares which may or may not materialize - such as what took place in 2022 & 2023.

Going forward, staying diversified with a portfolio of cash generating investments that trade at a reasonable valuation will be paramount. Additionally, now is a good time to revisit past pieces we have written that illustrate why trying to time the market is futile in the long run (here, and here).

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.