Where Are We in the Business Cycle

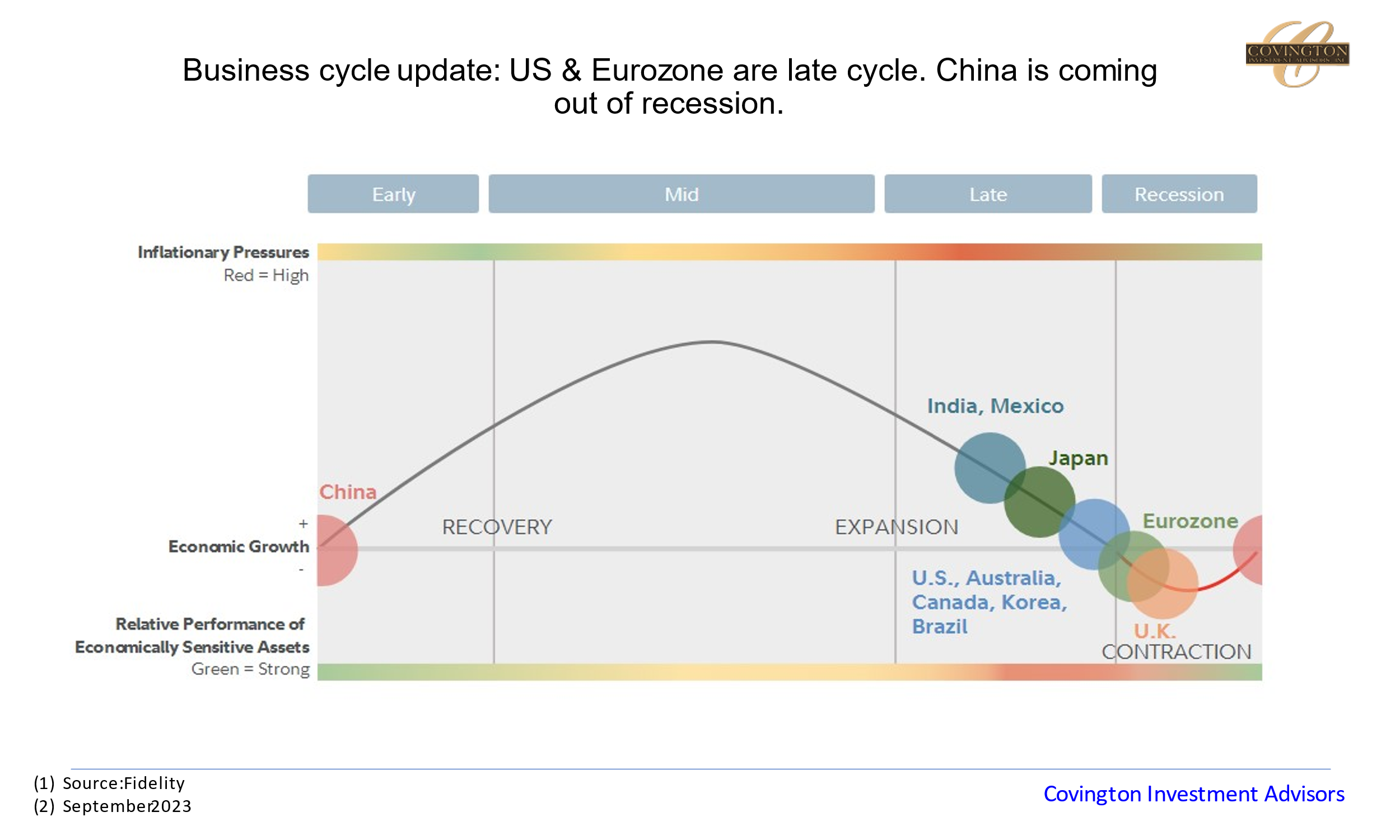

The US economy is currently in the late cycle of an economic expansion where economic growth is slowing, but it is still positive. This phase is typically characterized by rising inflation, tighter monetary policy, and increased volatility in the stock and bond markets, all of which you have seen over the last two years. We have been warning of this as several indicators have begun to point towards the US being in late cycle and many signaling the US entering a recession in the next 12 months. The root cause of these developments has been the fed’s monetary policy of raising rates to mitigate the impact of higher inflation.

The US economy is currently in the late cycle of an economic expansion where economic growth is slowing, but it is still positive. This phase is typically characterized by rising inflation, tighter monetary policy, and increased volatility in the stock and bond markets, all of which you have seen over the last two years. We have been warning of this as several indicators have begun to point towards the US being in late cycle and many signaling the US entering a recession in the next 12 months. The root cause of these developments has been the fed’s monetary policy of raising rates to mitigate the impact of higher inflation.

In the face of rising inflation, the Federal Reserve has embarked on their most aggressive rate hiking cycle in decades which will eventually slow down the economy. On the other hand, record low unemployment, large fiscal deficits, and strong household balance sheets have buoyed the economy and markets. But still, looking ahead, every time the Fed has embarked on a tightening cycle, an economic slowdown has followed, and with it, market volatility. However, the unusual nature of this post COVID cycle has distorted the normalization of rates and its impact on the overall economy. Even though the timing of this economic cycle may be different from past cycles, the principles for managing it remain the same.

Part of our job as your advisor is not only managing assets but managing emotions. Markets by nature are unpredictable because ultimately it is people that are transacting assets. We have commented before on the “manic depressive” nature of investors whereas they become too fearful close to the bottom and too euphoric close to the top. This creates both difficulties and opportunities. The difficulties come because it is never pleasant to weather a sell-off and see negative numbers. The opportunities come because extreme pessimism during selloffs is what gives investors opportunities to deploy capital into assets at attractive prices below their intrinsic value. This can come in the form of excess cash, dividend reinvestment, or companies themselves deploying retained earnings. This also hinges on owning a diversified portfolio of proven enterprises that have strong balance sheets and provide cash flow to shareholders even through the trough of market cycles. This has always been our bias.

Equally crucial to price and fundamental analysis when selecting investments is having the discipline to stay the course and allowing time and compound interest to do their work. Part of this discipline is sticking to the financial plan we put together for you. This means having 6-12 months of operating cash set aside as an emergency fund so that when market volatility arrives assets do not have to be sold at an inopportune time. It also means sticking to budgets and not diverging from your set asset allocation.

As the Fed achieves their goal of 2% inflation (current inflation is 3.7%) they will kill the current economic expansionary period. The market, businesses, and consumers will have to adjust to higher rates which have impacted housing, auto, and general consumption costs. Which in turn are impacting earnings. Corporate earnings for the S&P 500 are currently trending towards $220 for 2023 which will be roughly flat compared to $218 for 2022. Once that adjustment is made the business cycle will need some stimulus to push the economy into the Early business cycle phase of economic expansion. That will be when corporate earnings inflect back towards their expansionary growth rate of 8-12%. What will drive the expansion? Housing, energy transformation, infrastructure, and the next generation of industrial revolution including AI and the technology that supports it will be the key drivers. But to get to that expansion we will need to get inflation under control in order to start the next cycle. Patience will need to be adhered to in order to achieve long-term financial goals.

So, as we head into the next few quarters, be prepared for increased market volatility whether the Fed is done raising rates or not. Following your financial plan, staying disciplined, and investing in high-quality companies with strong fundamentals is how you achieve your long-term investment goals.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.