Out of the Woods?

Quite the turnaround from last year, markets have clocked a strong first half of 2023 with the S&P 500 and NASDAQ both up double digits. What's more is that this overall reversal in market performance applies to sub sectors with many of the worst performing pockets of 2022 being the best performers in 2023. Of course the leader this year has been large-cap tech which got pummeled in 2022 but has roared back accounting for almost all of the broader index’s return in 2023. We wrote about this recently in a note which can be found here. Fixed income markets have also stabilized and now offer pretty attractive yields across the curve.

And so you really have quite the intense change in sentiment in a six month period. Starting in about March last year markets really began to worry about the prospects of an impending recession as growth began to slow and the Fed embarked on their tightening policy to tame inflation. By the fourth quarter of 2022 many were portending that the US was actually already in a recession as GDP underwent consecutive quarters of negative growth due to a combination of economic slowing and component mixture. We did not think the US was in a recession yet but we did think one approaching in 12-24 months as written about in our holiday FAQ note here. Fast forward 6 months and now the prospects of a recession seem like a distant memory and equities are being priced not only as if a soft landing has been achieved but that a new expansion has begun.

So the question is are we out of the woods? We don't think so yet. An inherent characteristic of public markets is that they have a tendency to over exaggerate things – both on the up and downside. Last year when markets were plunging with many equities priced for a deep recession we felt that was probably an exaggeration on the downside. This year you have indices roaring back with the tech-heavy NASDAQ having its best 6 months in 20 years and the entire market seemingly predicting that AI will create an upward inflection in the trajectory of economic growth going forward… That's probably an exaggeration on the upside.

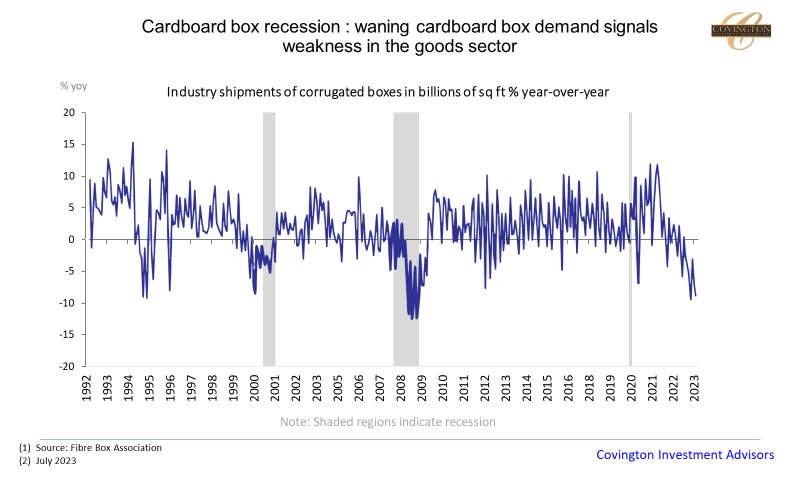

The reality is probably somewhere in the middle. The risk of a recession in the next 12 months is still present amid several indicators flashing warning signs. The most reliable is an inversion of the yield curve which has accurately predicted the last 8 recessions. What an inverted yield curve essentially means is that interest rates for near term loans is higher than rates on a longer dated loan signaling that interest rates are expected to fall in the coming years - which correspondingly signals economic growth would also fall. A counterargument to this theory in today's case is that the yield curve inversion could be a sign of a sharp decrease in inflation rather than a recession. Possible, but a sharp drop in inflation without a corresponding contraction in economic growth is tough to achieve. Nevertheless, several other indicators such as manufacturing surveys and leading economic indexes have also pointed towards muted growth and investors ignore these at their own peril. Another caveat with these economic indicators is that although they have a good track record of predicting a recession, the timing is not consistent. In the case of the yield curve inversion there have been times where it preceded a recession by almost 3 years. One of the more anecdotal indicators is today's chart which shows the price of corrugated shipping boxes giving a hint into the health of the goods part of the economy.

Meanwhile the economy has been much more resilient than expected amid the Fed raising interest rates from 0% to almost 6% which will eventually slow the economy. Corporate earnings are projected to be flat for the year and first quarter numbers have actually been below where they were in 2022. But falling inflation, record low unemployment, a resilient consumer, and optimism over AI have supported markets in the meantime.

In short, we think the economy remains strong for now which should buoy markets. But looking out several quarters, equity markets (particularly in the technology space), have likely gotten ahead of their skis and are ripe for a re-pricing. This should result in a mean reversion among market sectors and a broadening out of the rally if this is truly the start of a new bull market.With the flashing signs that a stretch of sub-trend growth could be ahead, maintaining a modest risk profile and rebalancing to value strategies is warranted in our view. Now is not the time to chase valuations higher but remain committed to a tested investment strategy of purchasing strong securities at reasonable prices and then allowing them to compound their value through both expansions and contractions.

Commentary Disclosures: Covington Investment Advisors, Inc. prepared this material for informational purposes only and is not an offer or solicitation to buy or sell. The information provided is for general guidance and is not a personal recommendation for any particular investor or client and does not take into account the financial, investment or other objectives or needs of a particular investor or client. Clients and investors should consider other factors in making their investment decision while taking into account the current market environment.

Covington Investment Advisors, Inc. uses reasonable efforts to obtain information from sources which it believes to be reliable. Any comments and opinions made in this correspondence are subject to change without notice. Past performance is no indication of future results.